Pulse: International Trade and Investment

IMF: A Remarkably Resilient Global Economy, but…

Economic policymakers from around the world are gathered for the Annual World Bank/IMF meetings during a particularly fraught time. In the immediate future, the world faces the potential for a broader war in the Middle East that could lead to a spike in oil prices. In the medium term, geo-economic fragmentation (aka rising protectionism) could affect global growth.

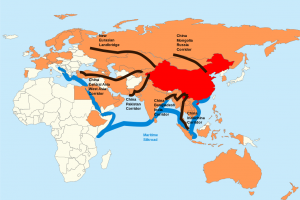

GLOBAL FINANCIAL ARCHITECTURES (PART THREE): CHINA AS A GLOBAL CREDITOR- THE BELT AND ROAD INITIATIVE AND OTHER PROGRAMS

“When you give roses to others, their fragrance lingers on your hand” Chinese President Xi Jin Ping

Macroeconomic Color: Indonesian Elections

One of Asia’s most consequential countries went to the polls in the past two weeks, as Indonesia held presidential, parliamentary and local elections on February 15th. Indonesia is the largest and second largest Moslem country I the world, and the third largest democracy globally.

GLOBAL FINANCIAL ARCHITECTURES: THE VIEW FROM THE GLOBAL SOUTH-BRICS

This is the second in a series of articles about global financial developments analyzing the changing Global Financial Architecture in the age of confrontation between the West and the Global South. In the first article, we presented the presents the background of the emergence of challenges to the Western-dominated Global Financial Architecture. This article focuses on he BRICS

The China Report February 6, 2023 #3 - High Anxiety

This weekend I expected to be writing about the results of Secretary of State Anthony Blinken’s trip to China and prospects for the reopening of China’s post-Covid economy. Instead, Americans have been mesmerized by the week-long journey of a Chinese balloon, and I have been bombarded with questions about what it means. A symbol of both China’s rise and presence in the US, a white balloon galvanized the media in a way that a diplomatic visit would never have equaled.

A Dollar Reprieve

The dollar has reversed its seemingly inexorable rise, with the weighted average dollar index falling from its 10-year high at the end of September. While it is too early to detect a trend, this development, alongside a softening of interest rates, is a welcome reprieve for emerging markets and low-income countries.

Disentangling the Crypto Crash of 2022

A reckoning in the digital asset industry that started in June after the collapse of improperly collateralized investment assets gained new urgency in November. Following the professional and possibly legal improprieties that led to bankruptcy and chaos at the FTX cryptocurrency exchange, the industry is regrouping and putting distance between legitimate market participants and the grifters.

Bali and Cairo: A Challenging Set of Global issues Meets the Climate Emergency

The Bali Summit is occurring at a time of intensifying challenges facing the global economy.

Global Manufacturing: The Canary in the Coal Mine

The Purchasing Managers Index (PMI) is a forward-looking indicator based on monthly surveys of purchasing managers. As a “Diffusion Index”, values above 50 indicate expansion relative to the previous month, and below 50, contraction relative to the previous month. As such, it is a key piece of the economic puzzle. There are several PMI indices: manufacturing, services and composite. In this piece, the focus is on PMI Manufacturing

by

by

by

by

by

by