Pulse: Macro

IMF: A Remarkably Resilient Global Economy, but…

Economic policymakers from around the world are gathered for the Annual World Bank/IMF meetings during a particularly fraught time. In the immediate future, the world faces the potential for a broader war in the Middle East that could lead to a spike in oil prices. In the medium term, geo-economic fragmentation (aka rising protectionism) could affect global growth.

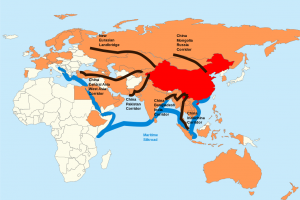

GLOBAL FINANCIAL ARCHITECTURES (PART THREE): CHINA AS A GLOBAL CREDITOR- THE BELT AND ROAD INITIATIVE AND OTHER PROGRAMS

“When you give roses to others, their fragrance lingers on your hand” Chinese President Xi Jin Ping

The Third Rail: Navigating the Geopolitical Power Grid in 2024

January 23, 2024

Joel Ross, who writes the legendary Wall Street newsletter The Ross Rant, sent me a question after reading Karim Pakravan’s recent guest post on EconVue+. Given all the geopolitical trends and events now underway, what is my conclusion about the state of the world, and what does that mean for people trying to make decisions in the new year?

Macroeconomic Color: Indonesian Elections

One of Asia’s most consequential countries went to the polls in the past two weeks, as Indonesia held presidential, parliamentary and local elections on February 15th. Indonesia is the largest and second largest Moslem country I the world, and the third largest democracy globally.

GLOBAL FINANCIAL ARCHITECTURES: THE VIEW FROM THE GLOBAL SOUTH-BRICS

This is the second in a series of articles about global financial developments analyzing the changing Global Financial Architecture in the age of confrontation between the West and the Global South. In the first article, we presented the presents the background of the emergence of challenges to the Western-dominated Global Financial Architecture. This article focuses on he BRICS

Global Financial Architectures: A Decoupling

This is the first in a series of articles about global financial developments analyzing the changing Global Financial Architecture in the age of confrontation between the West and the Global South. In the first article, we present the presents the background of the emergence of challenges to the Western-dominated Global Financial Architecture. Other articles will analyze the GFA 2.0 institutions.

October 29 Comment to International Finance Forum 20th anniversary meeting in Guangzhou

For video delivery, 14:00 CST, Sunday, October 29, 2023; 23:00 PDT, Saturday, October 28, 2023

(Marsha Vande Berg, member of the IFF Academic Committee; Independent Corporate Director and Advisor with expertise in Asia Pacific capital markets. Former Chief Executive Officer, Pacific Pension & Investment Institute)

Technology is the economic security tool driving US-India ties

After PM Modi's US state visit, it is apparent that the partnership between the US-India will rely on tech and innovation to achieve greater economic security.

It may be stating the obvious that technology is central to Prime Minister Modi’s realization of his twin goals for rapid-fire and sustainable economic growth – all the while creating jobs for the world’s largest population.

by

by

by

by

by

by

by

by