Pulse: China

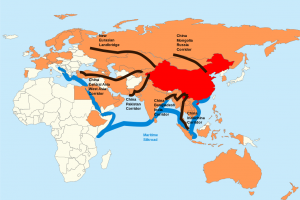

GLOBAL FINANCIAL ARCHITECTURES (PART THREE): CHINA AS A GLOBAL CREDITOR- THE BELT AND ROAD INITIATIVE AND OTHER PROGRAMS

“When you give roses to others, their fragrance lingers on your hand” Chinese President Xi Jin Ping

October 29 Comment to International Finance Forum 20th anniversary meeting in Guangzhou

For video delivery, 14:00 CST, Sunday, October 29, 2023; 23:00 PDT, Saturday, October 28, 2023

(Marsha Vande Berg, member of the IFF Academic Committee; Independent Corporate Director and Advisor with expertise in Asia Pacific capital markets. Former Chief Executive Officer, Pacific Pension & Investment Institute)

China, the BRICS and the Challenge to the US Dollar

In a recent official trip to China, Brazilian President Lula da Silva called for an end of the dominance of the US dollar in world trade, a message that has been echoed by the China, Iran, Russia, as well as other countries. This message reflects the acceleration of the trend towards fragmentation(or deglobalization) of the global economy and the Chinese-led challenge to the Bretton Woods US dollar-dominated global economic architecture, an architecture that looks increasingly frayed and rudderless.

The China Report February 6, 2023 #3 - High Anxiety

This weekend I expected to be writing about the results of Secretary of State Anthony Blinken’s trip to China and prospects for the reopening of China’s post-Covid economy. Instead, Americans have been mesmerized by the week-long journey of a Chinese balloon, and I have been bombarded with questions about what it means. A symbol of both China’s rise and presence in the US, a white balloon galvanized the media in a way that a diplomatic visit would never have equaled.

The War of the Words: December 2022 Spotlight

Demonization and its economic consequences, and a peek ahead to the 118th Congress

Toward a Strategy for Responding to the PRC in Latin America

The work argues that the problem is not the “lack of a strategy,” but ensuring that the strategies that we apply are appropriate, adequately resourced and coordinated, and the tools we use are up to the task. In addition to concisely stating the nature of the risks to the US and the region arising from some dimensions of PRC engagement, the recommendations advanced by the work include: (1) holding the line for Western corporations, strategic technologies and liberal institutions, (2) helping our partners to strengthen their institutions to get a better deal from their work with the PRC and other actors; (3) fixing, rightsizing and better coordinating our institutional tools for competing, (4) improving our data supported messaging, and (5) advancing clear new strategic concepts for the military as part of a whole of government response, coordinate with our likeminded allies.

Change of Edge - EconVue Spotlight October 2022

Are central banks overreacting to inflation? Are we in for a positive surprise?

Hidden Damages: August Spotlight 2022

Is Covid just a dress rehearsal? What have we learned about living with our biological and geopolitical adversaries?https://www.washingtonpost.com/health/2022/08/19/long-covid-brain-effects/

by

by

by

by

by

by

by

by

by

by