The World Bank International Debt Report-Poorest Countries at Risk

posted by Karim Pakravan on December 12, 2022 - 2:53pm

In its latest “International Debt Report”, the World Bank warns of adverse developments in the global debt dynamics for emerging and low income countries. The World Bank data covers the period 2010-2021. Over this period, the external debt of emerging markets and low income countries (Middle Income, MIC, and Low Income, LIC, in World Bank parlance) has more than doubled, to $9.3 trillion—26% of Gross National Income, GNI. Debt to exports, a more meaningful measure of the debt burden has risen to 102%. Debt Service payments (principal and interest) have increase by 148% to $1.1 trillion, from 9.4% to 13% of exports.

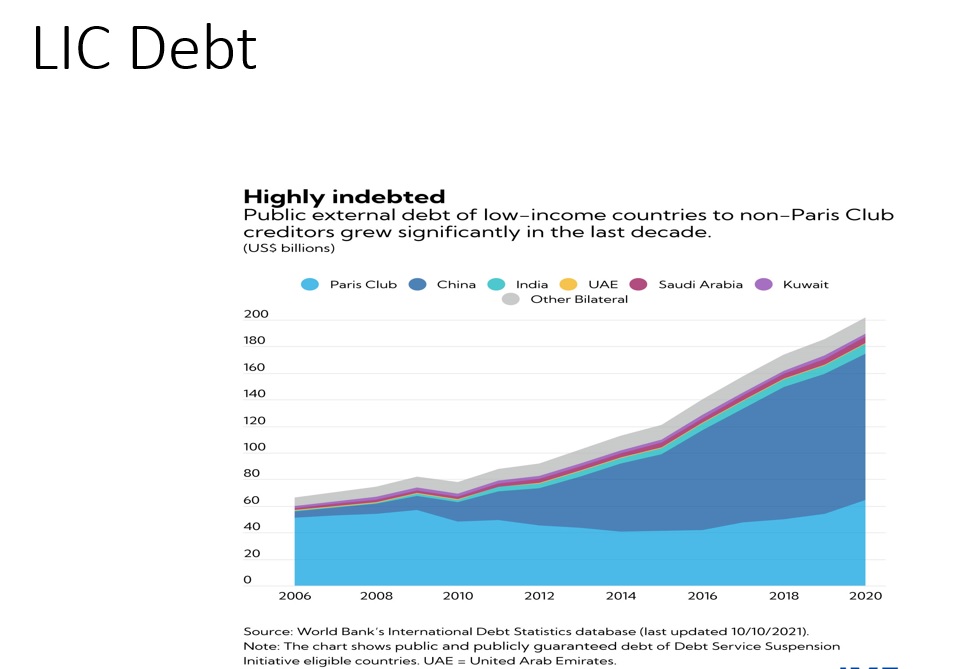

Fig.1 : LIC Debt

The World Bank report underscores the increasing difficulties faced by the poorest countries (the so-called Low Income Countries, LIC) in servicing their external debts. In my previous posts, I stressed the differences between the situation in the emerging markets, (or MICs under Word Bank parlance) and the LIC countries. Emerging market problems are challenging, but manageable. At the same time, while not all of the LICs are at risk, 60% of countries covered by IMFs “Debt Service Suspension Initiative” (DSSI) face high risks of debt distress (aka default), or are already in default.

Table 1: Key External Debt Indicators

In regard to all the external debt indicators, all MICs and LICs were in a worse condition in 2021 compared to 2010. At the same time, the problems facing these countries are not recent, with the 2020-21 COVID period seeing a further worsening in their risk profiles.

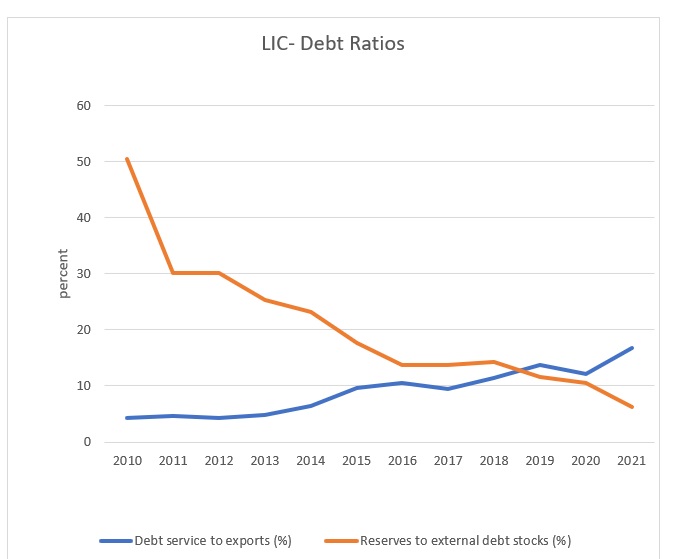

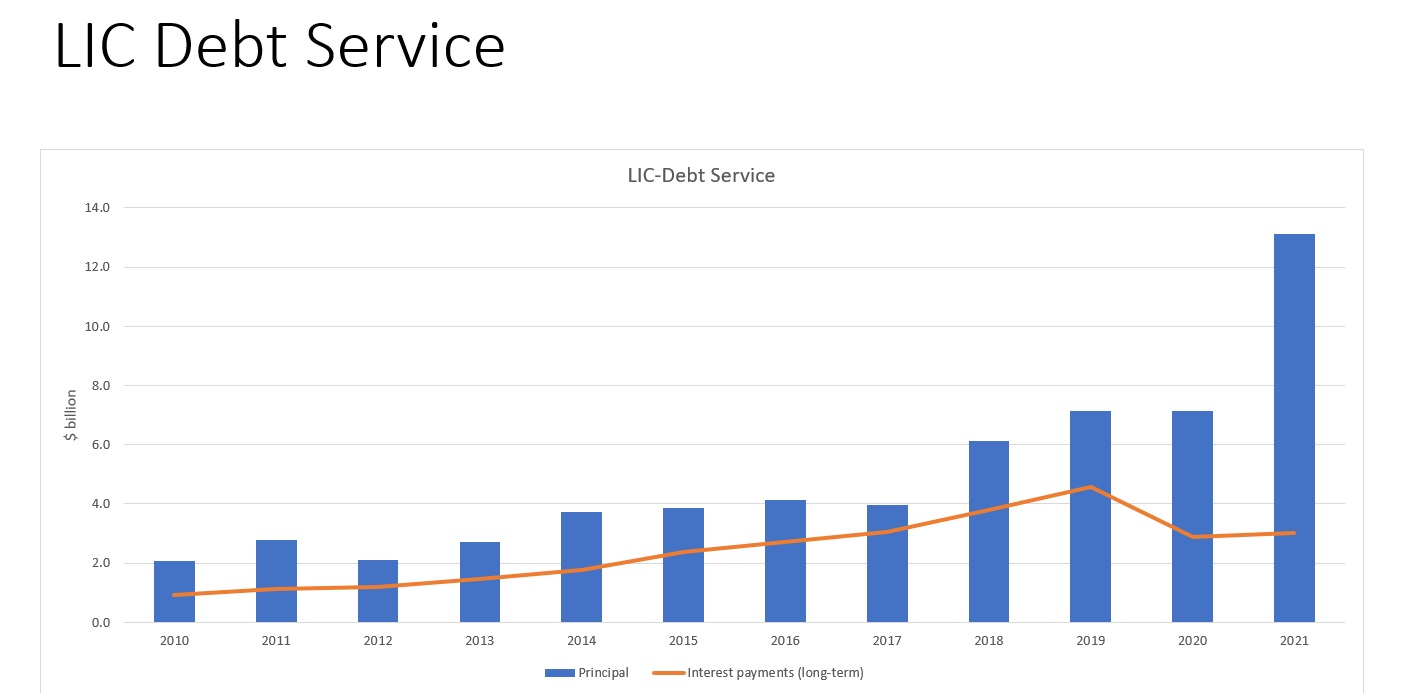

Fig. 2: LIC Debt Service

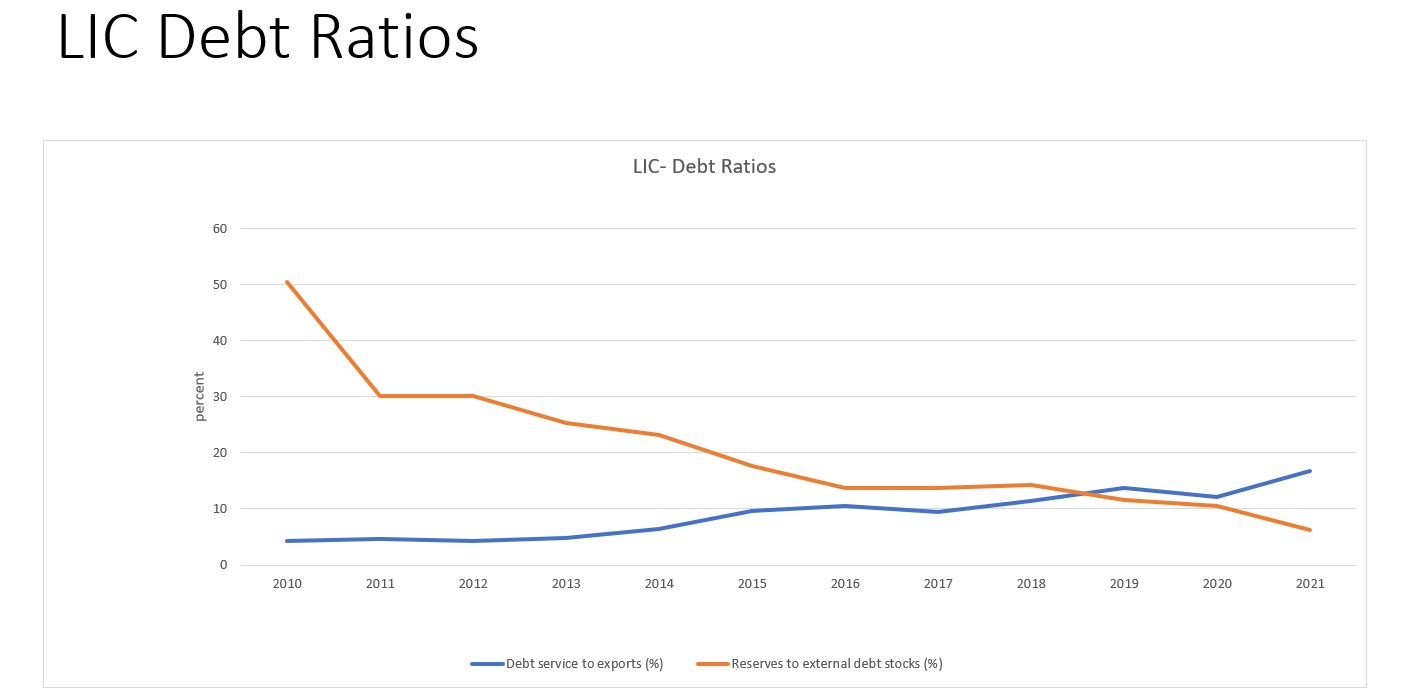

With regard to the LICs, the data indicates a sharper deterioration. The Debt to GNI ratio has almost tripled between 2010 and 2021. However, the picture is more challenging under other, more representative measures: the Debt Service to Exports ratio reflects the share of export revenues that has to be devoted to servicing the external debt, resources that could otherwise be used to import needed good and services. This indicator has increased from 4.7% to 16.8%. The Foreign Exchange Reserves to External Debt ratio, which reflects the availability of foreign exchange to cover external debt obligations, has all but collapsed, from 50% in 2010 to 6% in 2021.

Table 2: LIC Debt Service

In dollar terms, the LIC Debt Service total increased from $3 billion in 2010 to $16.1 billion in 2021. The principal payments increased by a factor of 6 over the period to $13.1 billion in 2021

Fig. 3: LIC Debt Ratios

The World Bank data does not cover 2022. Nevertheless, it is clear that the LICs are facing stronger headwinds in 2022: higher interest rates, a stronger dollar, tighter global credit conditions, and a food and energy crisis caused by the war in Ukraine. Under these circumstances, debt relief, as well as outright debt forgiveness, are once again urgently needed.

In the past, the bilateral and multilateral official creditors have implemented a first round of debt relief and forgiveness with two programs: the Highly Indebted Poor Countries (HIPC, 1996) and the Multilateral Debt Relief initiative (MDR, 2005). By 2018, about $100 billion of debt relief (through reschedulings, interest reduction and outright forgiveness) had been implemented for 37 countries (31 of which were in Africa). Post-COVID, the DSSI program postponed $12.7 billion of payments due between May 2020 and December 2021, but the program ended in December 2021. Currently, the G20 countries and the Multilateral Financial Organizations are still struggling to complete the framework of the so-called Common Framework to deal with the problem. Furthermore, China, which has become one of the biggest global creditors, is just starting to be involved in debt relief initiatives.

The LIC debt problems do not create systemic risk for the global financial system, since most of the debt is to official creditors. Moreover, the LIC debt represents about 3% of the total Emerging Markets MIC/LIC GNI. In the aggregate, this is a manageable problem, but debt relief without a re-thinking of the deeper structural problems of the global financial architecture would meant that we are kicking the can down the road.