Pulse

Alberto Fernandez' Magical Odessey to Russia and China

President Alberto Fernández’s state visit to Russia and the People’s Republic of China (PRC) this month was tragic for Argentina—its national interests, its reputation as a democratic voice in the region, and moderates within Peronism who sincerely believe in the government as a tool for social justice and progress.

It’s The Payment Models, Stupid! Maryland Leads The Way, Part 1

On February 9th and 10th, Health Affairs published a two-part article by Zeke Emanuel, Merrill Goozner, Matt Guido and me on Maryland’s unique payment model and its potential applicability to other states. (Part 1, Part 2) For reasons that will become obvious, we took inspiration from an extremely influential 2003 Health Affairs commentary with the provocative title, “It’s the Prices Stupid.”

Cracks in the Foundation — 5 Structural Defects Are Undermining Nonprofit Healthcare

Everyone who works in healthcare understands one simple fact: It’s a business. But we can’t ever forget it’s also a business with a soul.

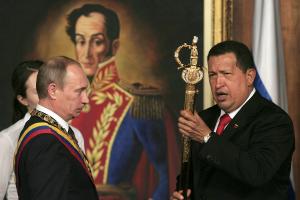

Russia’s Latest Return to Latin America

The indirect threat made by Russian Deputy Foreign Minister Sergei Ryabkov as the crisis in the Ukraine escalated in January 2022, that Russia could not rule out deploying military forces to Venezuela and Cuba, highlighted the strategic risks posed by Russia’s position in the Western Hemisphere.

Preparing for Deterioration of the Latin America and Caribbean Strategic Environment

The article examines the historically unprecedented turn to the Left, and to authoritarian populist regimes, across in Latin America and the Caribbean.

EconVue Spotlight January 2022 - Skating, On Thin Ice

In just a few weeks, the Winter Olympics will be held in Beijing. Both Japan and China were unlucky in their timing; these Games without an audience must be bittersweet for participants as well. For me personally, they bring back memories.

Latin America and Caribbean Predictions for 2022

This report was originally published by the Global American.

It’s a Biden Boom—and No One Has Noticed Yet

If the current high levels of economic, job, and income growth continue, the 2020 midterms could look different than most are predicting.

by

by

by

by

by

by

by

by

by

by