The World Economy in 2023 in the Shadow of Davos

posted by Karim Pakravan on January 17, 2023 - 3:58pm

The much-maligned political, business and intellectual elites descend on the Swiss resort town of Davos for the meeting of the World Economic Forum (WEF), now in its 52nd year. Attendance in the WEF meeting is back to its pre-COVID levels, and the eponymous Davos man (or woman) is facing a set of unprecedented challenges dubbed a “polycrisis” by historian Adam Tooze: a disastrous war in Ukraine, a synchronous and painful monetary tightening by the major central banks in the face of stubborn global inflation, a sputtering Chinese economy emerging from COVID lockdown, economic fragmentation and deglobalization, climate change and emerging markets in crisis.

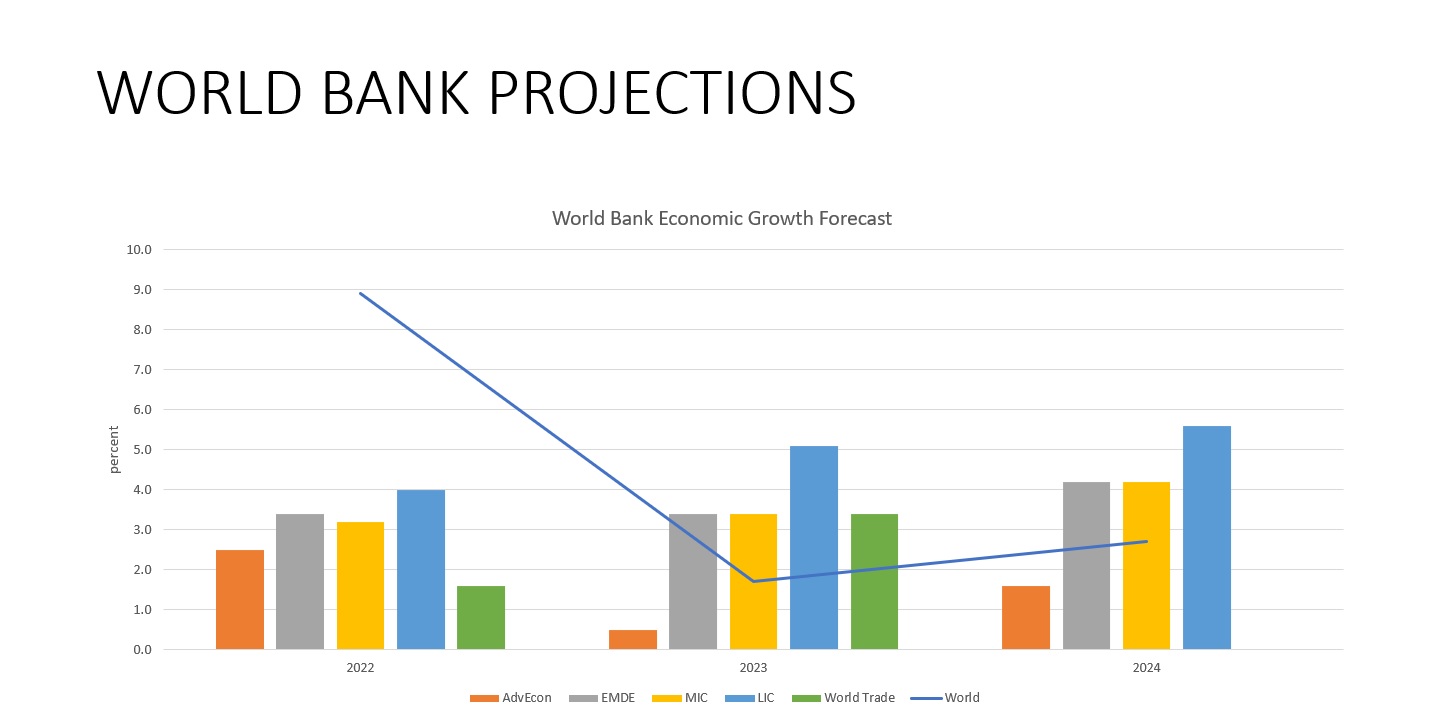

The Davos meeting comes at a time when there is considerable uncertainty about the state of the global macroeconomy. The IMF predicts that a third of the world’s economies will be in recession in the next few months. The recent World Bank report on the global economy projects a sharp slowdown in economic growth in 2023, stating that : “Global growth is slowing sharply in the face of elevated inflation, higher interest rates, reduced investment, and disruptions caused by Russia’s invasion of Ukraine”.

World Bank Economic Forecast, 1/2023

While the global slowdown is a reality and the global economic situation remains challenging in 2023, we need to also recognize that we ended 2022 on a slightly improved note, and that we have witnessed a reprieve in the past few weeks

Oil prices (West Texas Intermediate, WTI) are down 38% from their peak of $120 in June, and have fallen below their pre-Ukraine war level; natural gas prices are down in Europe, back to their pre-war levels; and commodity prices (Bloomberg Commodity Prices Index) are down about 20% from their end-August peak.

The predicted energy apocalypse in Europe did not happen, as warmer weather, a diversification of energy sources and record natural gas storage levels have helped to avoid one. Furthermore, long-term interest rates are down, with the US 10-year T yield down from its high of 4.25 % on 10/25/22 to 3.55% in early January; the dollar has weakened, with Dollar index (DXY) down 9% from its peak at the end of September, with the euro strengthening accordingly. Furthermore eurozone economy avoided a contraction in the fourth quarter.

Finally, the labor markets in the US are cooling down gradually, but showing resilience

European unemployment continues to fall, and inflation seems to have peaked in the US and Europe, although inflationary pressures are likely to continue in the medium-term.

While the World Bank is spot-on when predicting a sharp slowdown in global growth, these factors could help the world avoid a recession, or at least mitigate the depth or intensity of one. The evolution of the global economy in 2023 and 2024 will depend on a number of key factors.

First and foremost will be the ability of China to emerge from its COVID-driven slump. According to official data, the Chinese economy grew by 3% in 2022 (2.8% in 4Q2022), significantly below the pre-Covid average of 10%. The slowdown was largely due to the repeated and drastic lockdowns of the past few months. With the easing of the lockdowns, the economy is expected to rebound somewhat, although important sectors such as real estate will remain in recession. The reopening of the Chinese economy should have a positive impact on global supply changes over the medium term. However, faster Chines growth will also lead to

oil prices increases, particularly as OPEC fulfills its plan to cut production by 2MBD. OPEC has cut production by almost 1MBD since its high of September.

Monetary policy tightening by the major central banks is expected to abate by the end of the first quarter of 2023. The US benchmark rate (Fed funds) should reach 5.00-5.25%, its highest level since 2007. Global financial market commissions should remain tight.

Geopolitical risks will remain high, Ukraine being the foremost. Additionally, the hardline taken by the Republicans controlling the US House of Representatives on raising the debt ceiling and the broader risks posed by US Congress dysfunction have increased the odds of financial turmoil in the United States Treasuries market in the next few months.

Bottom line, we should expect slow growth or a shallow recession in the first half of 2023, followed by a gradual recovery in the second half

Emerging markets (EMDEs, or Emerging Markets and Developing Economies in World Bank jargon) will continue to be challenged. The largest emerging market economies should be resilient, although we should continue to watch developments in Turkey, Argentina and Egypt. However the poorest countries (low income countries, LICs) continue to face dire conditions, aggravated by climate devastation (droughts or floods), food insecurity, unsustainable levels of debt, and little room for maneuver. As such, they will require a major debt forgiveness and financial recovery action by the major multilateral and bilateral financial donors.