Volcker Offers Lessons for the Fed and Other Policymakers

posted by Michael Lewis on December 11, 2019 - 9:09am

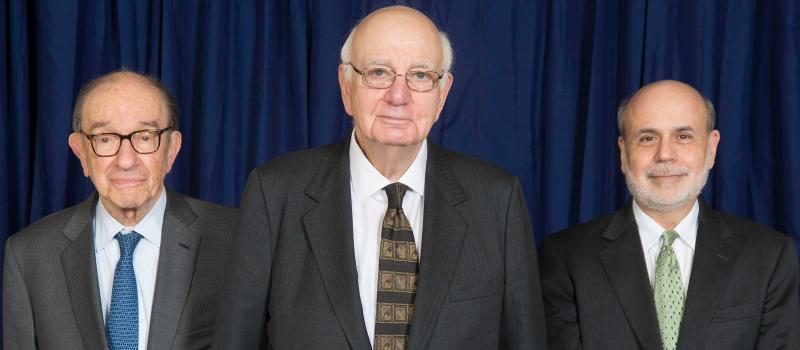

The passing of legends prompts renewed consideration of their achievements and, of times, conjures not-so-favorable comparisons to their successors. Paul Volcker, who died at 92 this week, set the standard for bold monetary policy as Fed chairman from 1979 to 1987. Taking the helm amid stubbornly high and rising inflation and lackluster trend real growth, he faced the Federal Reserve’s greatest challenge since the Great Depression. Like that earlier episode, bad decisions by his predecessors had created much of the crisis.

Though the term would not be applied to Fed policy for another 30 years, Volcker pioneered “shock and awe” policy, driving the fed funds target to unprecedented highs near 20% to control inflation at (almost) any cost. By comparison, the hapless Arthur Burns stopped at 13% in 1975; the target rate had averaged well under 5% in the 1950s and ‘60s. Volcker knew full well that his policy would push the economy into a deep recession -- he was not merely taking away the proverbial punch bowl, he kicked it over and called the cops to raid the party.

By comparison, Ben Bernanke, who coined shock and awe policy in 2008, was, almost literally, giving away money, a less daunting task.

Volcker’s strategy paid off in spades, setting up the pronounced economic expansion in the 1980s and contributing heavily to the “great moderation” in inflation that prevails to this day.

Volcker remained resolute in the face of the economic slowdown. He was helped by unqualified support, in public anyway, from two U.S. presidents. Volcker, a Democrat, ended what little hope Jimmy Carter had for re-election in 1980, and then set up Reagan for a drubbing in the 1982 midterms. Admittedly, neither Commander-in-Chief had much choice in the matter. The inflation part of the “misery index” had been relentlessly grinding Carter down, and Reagan needed to get past a recession early to set up his re-election bid. Still, neither president tried to make the Fed a scapegoat for their troubles. A lesson some presidents could stand to learn.

For all his success, Volcker also offers a cautionary tale. In his second term, with inflation seemingly broken and the economy humming, Volcker kept policy tight, even raising rates in 1987. Later Reagan appointees to the Fed Board wanted an easier policy. Volcker put down the rebellion by threatening to resign – about the only example of a Fed chairman having less than total control. While he won the day, Volcker retired rather than seek a renomination. It is impossible to know who was right, though the real economy and even the stock market (1987’s Black Monday aside) did fine for several years.

With the exception of Greenspan, and the “maestro” earned the Great Recession as his legacy, Volcker’s successors have strived for consensus on the FOMC.

To read FMI's full report, please visit www.freemarketinc.com.