The OECD Global Economic Outlook: Modest Recovery, but Risks Remain

posted by Karim Pakravan on March 27, 2017 - 2:33pm

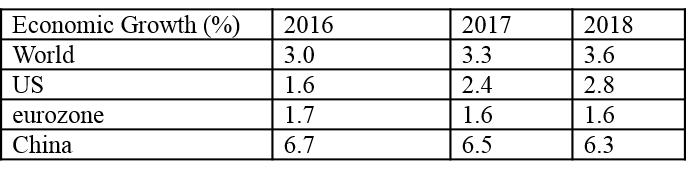

The Organization for Economic Cooperation and Development (OECD)[1] recently released its semi-annual economic outlook[2]. Three major themes emerge from the report. First, the global economy is gradually emerging from a five-year (2012-1016) low-growth trap, and global growth should pick up modestly in 2017and 2018 (Table 1). Second, we are seeing a shift in economic policy from over-reliance on monetary policy to fiscal initiatives designed to boost growth. Third, we are not out of the woods and significant risks remain.

Table 1: OECD Economic Projections

In the last few months of 2016, we have witnessed positive signs in the major economies: accelerating activity, sharp improvements in business and consumer confidence, a revival of global manufacturing, and the fading of deflationary pressures. Other forward looking indicators, (in particular global and national Purchasing Managers Indices, PMI) support the OECD view. In addition, the recovery in commodity prices, in particular the price of crude oil, has boosted the economic prospects of emerging markets, as well as those of the hydrocarbon industry in the United States and Canada. Global trade is recovering after a period of exceptional weakness, in particular in Asia. However, global trade growth is unlikely to reach pre-2009 levels.

The OECD credits the pickup in economic activity on the fading of fiscal headwinds in the major economies (the United States, Canada, China and to a certain extent the Eurozone), with an on-going and prospective loosening of fiscal policy after several years of fiscal tightening.

Nevertheless, the OECD report also stresses some key risks:

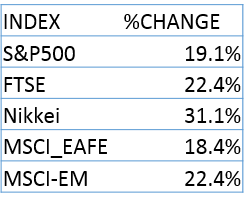

- The disconnect remains between financial market valuations and economic fundamentals. While global equity markets surged after the election of Donald Trump to the U.S. presidency on November 8 of last year, the bull market had already begun in the aftermath of the Brexit vote at the end of June. The MSCI-World index gained 17.8% between end-June 2016 and its recent mid-March peak, and the main global and national indices also showed similar gains (See Table 2)

Table 2: Main Equity Market Indicators (June 2016-March 2017)

- Rising rate divergences among the major economies (the Fed starts tightening, while the Bank of England and the European Central Bank (ECB) have indicated potential future tightening and the Bank of Japan stays put), which increases the risks of currency markets volatility

- Emerging markets remains vulnerable to downside risk, with high levels of (foreign currency) corporate debt, non-performing debt problems in the banking sector and vulnerability to external shocks

- Housing market bubbles are developing in several markets

- Anti-globalization and rising protectionism remain an issue

In addition, the OECD focused on the impact of high levels of real income and wealth gaps on the strength of the underlying recovery.

The OECD ends its report with a series of recommendations. First and foremost, the OECD wants the major economies to rebalance even further economic policies towards fiscal stimulus and structural reforms. The OECD also stresses the need to strengthen macroeconomic risk management, with robust early warning and macroprudential measures in place. The OECD also warns the ECB and the Bank of Japan against a premature tightening of monetary policy. Finally, emerging markets (and in particular China) should deal with the weaknesses of their banking systems.

All in all, the OECD projections and recommendations mirror the more recent IMF reports[3]. Furthermore, they also fit in the changing global political framework where governments are either trying to react to rising populism (UK and the Eurozone), or embracing this trend (United States). However, reflating the economies could be easier said than done. Significant policy uncertainties remain. In the United States, the recent health care legislation debacle of the Trump administration has underscored the deep ideological divisions of the Republican Party. In Europe, Germany and other major countries still resist moving away from austerity. Nevertheless, the world is enjoying an economic respite, we are seeing convergence of growth among the major blocs, capital is flowing back to the emerging markets and global trade is recovering. We can only hope that this opportunity will not be squandered by deepening global antagonisms.

[1] The OECD is a multilateral economic and policy research organization. It’s membership of 35countries includes all of the advanced and major emerging market countries

[2] “Interim Economic Outlook”, OECD, March 7, 2017

[3] “World Economic Outlook Update” IMF, January 2017