The Italian Job

posted by Karim Pakravan on May 30, 2018 - 2:11pm

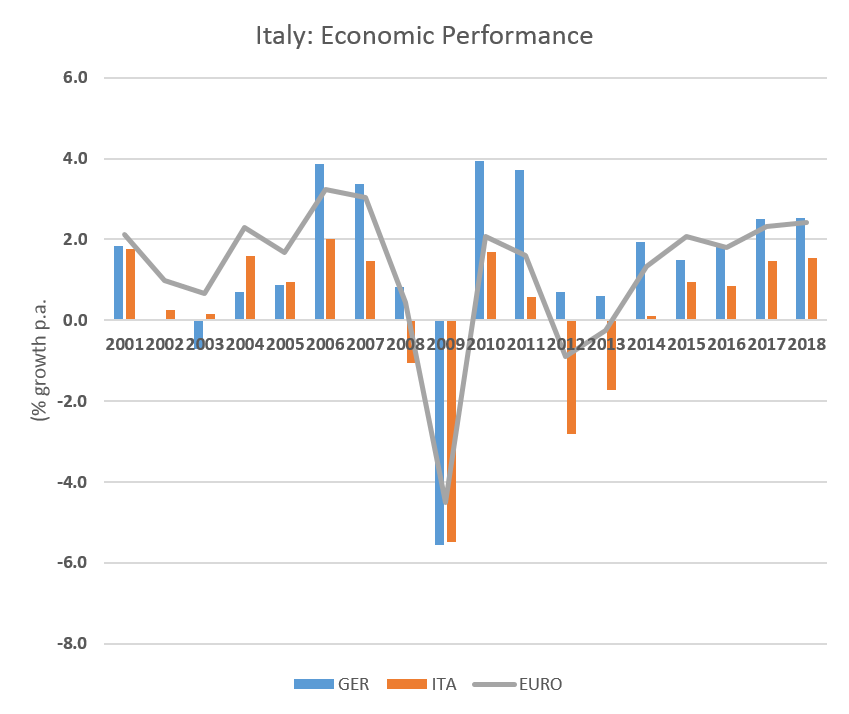

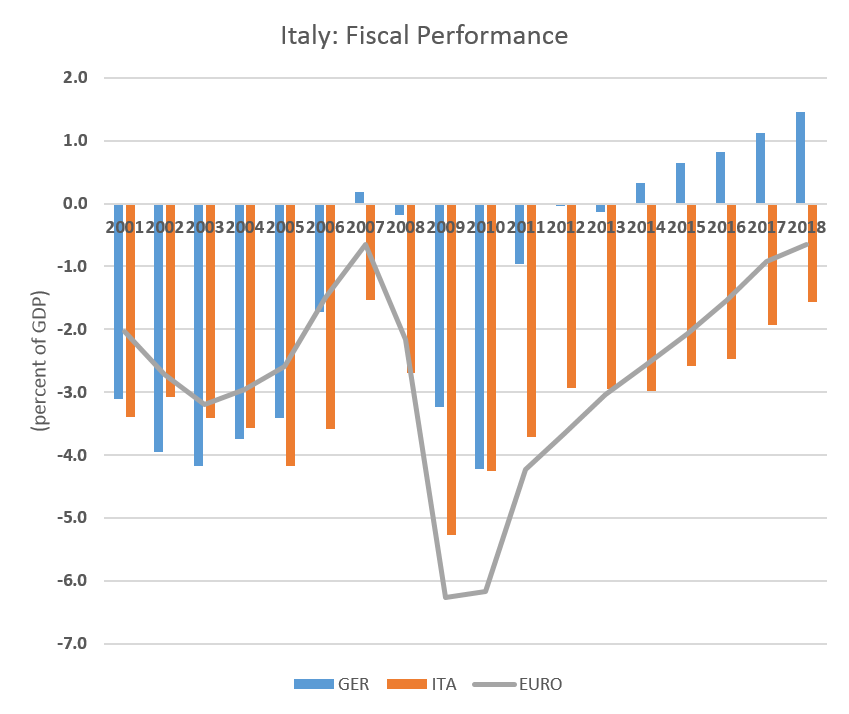

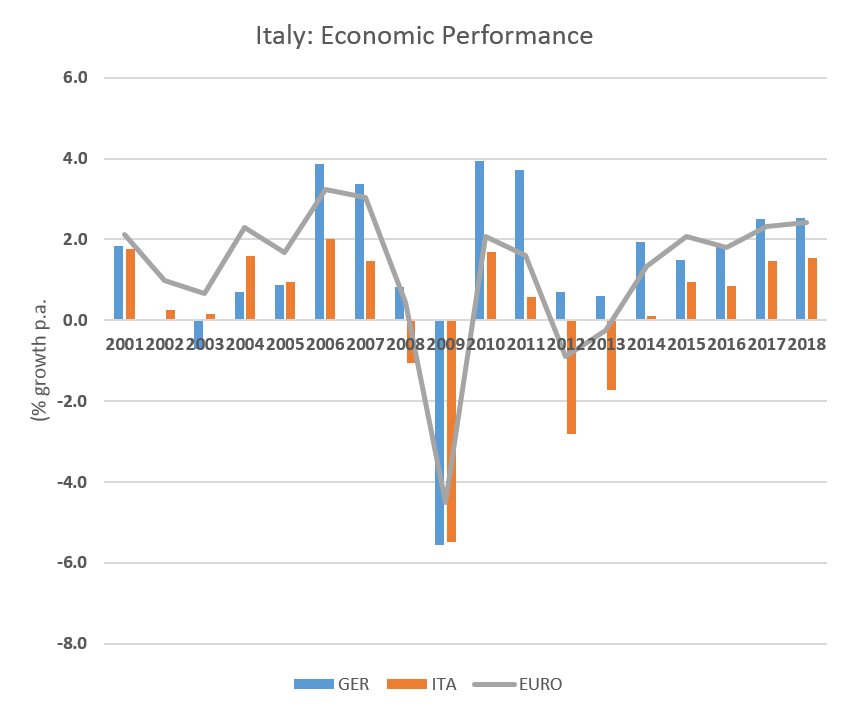

Economic Background: Italy is the fourth largest economy in the Eurozone, accounting for one-sixth of total GDP and one-fourth of total sovereign debt. The country, one of the six founding members of the European Union in 1958, joined the euro at its inception in 2002. The single currency was more of a political act than anything else, an expression of a deepening and irreversible economic union. While Italy did not fulfill the “convergence” conditions of the Maastricht Treaty—it’s public debt stood at about 120% of GDP--it was hoped that the euro’s “tail” would wag the Italian policy “dog”, forcing the Italian body politic to take the fiscal and economic reforms measures that would make the euro work. However, that did not happen, and the Italian economy has limped along since 2002, constrained by an uncompetitive exchange rate and a lack of a sustained structural reforms effort. Economic growth average 0.15% per year over 2002-2017 vs. 1.2% for the Eurozone as a whole. While economic growth picked up in 2016 and 2017 to around 1.5%, it still remains 1% lower than the Eurozone average. Real disposable income per capita is lower now than it was prior to joining the single currency. Unemployment stands at 11%, and youth unemployment at 35%. Nevertheless, the policy situation was not static, and a succession of governments tried their hand at economic and fiscal reforms. As a result, Italy had made significant progress, at least on the fiscal side, reducing its fiscal deficit by half in the past eight years to under 2% of GDP, and stabilizing its government debt at around 118% of GDP. Furthermore, Italy has managed to achieve a healthy current account surplus in the past few years.

The Current Crisis: The March 2018 parliamentary elections led to a rout of the ruling Democrats and the rise to power of two populist parties: the right wing anti-immigrant Lega (League) and the anti-establishment Five Stars, both Eurosceptic parties, which together won 50% of the votes. After months of wrangling, the two parties formed a coalition. However, attempts to form a government were nixed by President Matarella, who rejected the coalition’s choice of an anti-euro personality as Finance Minister. President Matarella has nominated a more conventional figure, IMF economist Carlo Cotarelli, to form a technocratic caretaker government. However, the political situation remains unresolved. First, Cotarelli has yet to get a parliamentary vote of confidence—which is not assured. Second, the League-Five Star coalition have not given up on their attempt to form a government. In any case, new elections within the next few months are likely, which would mean months of uncertainty.

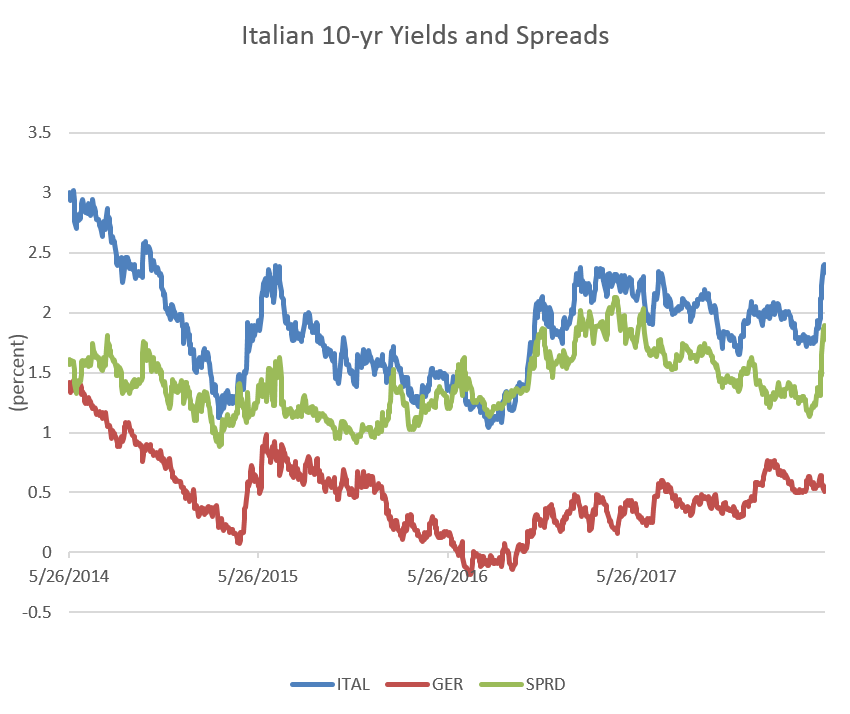

Unforgiving Financial Markets: Financial markets reacted sharply to the political chaos, pushing Italian bond yields on Italy’s €2.3 trillion debt sharply higher. Italian 10-year bonds’ yield jumped from around 1.8%in March to 2.4% at the end of May, and surged to over 3% on May 29 before falling back to around 2.8%--and the spread to German bonds surges to record levels. Furthermore, markets also experienced some degree of contagion, with yields rising for Greek, Spanish and Portuguese bonds. The Italian shock reverberated through financial markets, with all the major equity markets experiencing sharp drops on 5/29 before recovering somewhat.

Central Banks Reaction: The European Central Bank (ECB) will be at the center of market stabilization efforts. One of the main impacts of the Italian crisis is likely to delay the end of quantitative easing, probably to mid-2019. The Fed is unlikely to respond to the issue unless it proves destabilizing to the global economy.

No Exit: Both bond and equity markets seem to have overreacted in the very short term. Yet, the situation is far from settled. While the League and Five Stars had not explicitly called for a referendum on the euro (an “Italexit”), they remain strongly skeptical of the single currency. Furthermore, they had campaigned on undoing the economic reforms of the previous governments. The next elections, which I expect to happen within the next few months, or early 2019 at the latest, will be a referendum on the euro. Italexit is off the cards, for now-- public opinion remains in favor of remaining in the single currency. Nevertheless, uncertainty about the electoral outcome will continue to rattle markets. In the worst case –and low probability—scenario, a victory by the openly anti-euro forces could lead to a referendum on the single currency, and a drawn out period of crisis. But even if we discount such an extreme case, a destabilizing of the Italian economy and concerns about its debt would have far reaching consequences for the euro and, more broadly, for the Eurozone and global economy.