The IMF Strikes Back

posted by Karim Pakravan on April 20, 2017 - 3:07pm

“The global economy is gaining momentum, but further progress hinges on policies to support the recovery, lift productivity growth, and enhance resilience. Against the background of rapid technological progress, a cooperative multilateral framework for trade and financial integration has served countries well, producing large economic benefits. However, some groups have not been able to share in these benefits, a trend exposed by a too-slow post-crisis recovery, which limited the room for all segments of society to experience income gains. Working within the multilateral framework, countries should strive for strong and more balanced growth and to provide economic opportunities for all. To this end, they should anticipate the effects of technological progress and economic integration, equip their populations with tools to reap the benefits, and put in place domestic policies to share them more broadly. The Fund will assist members through carefully tailored policy advice, lending to smooth adjustment, and capacity development.”

“The Managing Director’s Global Policy Agenda”, IMF, Spring 2017

The globalist crowd is converging on Washington once again for the Annual Meeting of the International Monetary Fund (IMF) and World Bank (April 20-24). This meeting is being convened under the shadow of a U.S. president who has threatened (at least in his campaign rhetoric) to upend the global international financial and economic system in place in the past 70-years. This system--aka Bretton Woods, the brainchild of the British economist John Maynard Keynes and U.S. Undersecretary of Treasury Harry White—has been the underpinning of the global economy since World War Two. At its center are the daughters of Bretton Woods, the multilateral financial institutions (MLFI), the IMF and the World Bank, as well as the World Trade Organization, (WTO). Christine Lagarde, the IMF’s Managing Director, is using the meetings to mobilize her allies to strike back at the populist, anti-globalization rhetoric that has gained so much ground in the past few years, culminating in Brexit and the election of Donald Trump (and potentially, in the rise of a right-wing populist to the French presidency next month).

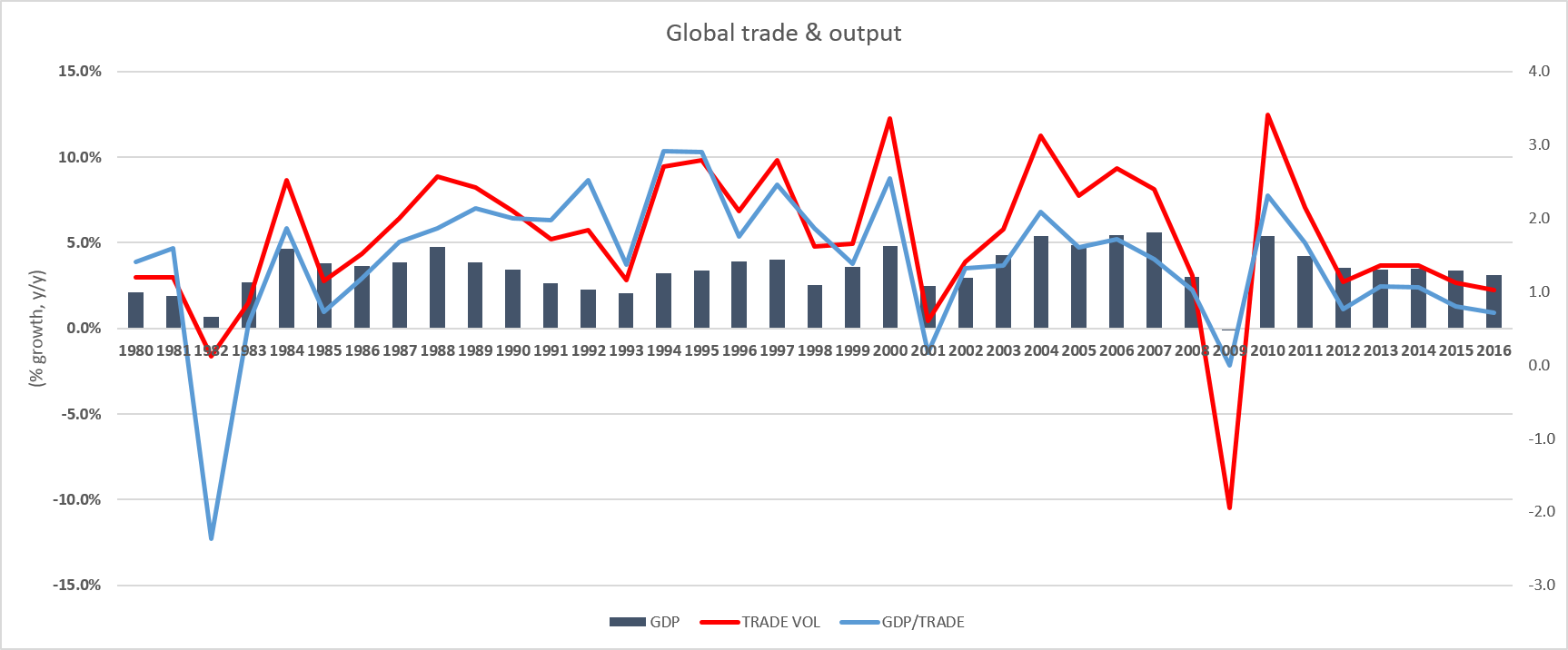

Fig.1: Global Trade-Ouptut Linkage

While the theme of the recent economic report of the IMF[1]has been the welcome renewed dynamism of the global economy after an extended period of sputtering growth, the report (as well as recent speeches by the leadership of the MLFIs), also includes a solid defense of globalization and multilateral economic and financial cooperation.

The IMF argues that the global economy has been well served by increased economic and financial integration, which has allowed a more efficient use of global resources, faster economic growth and rising standards of living, and the pulling out of poverty of hundreds of millions of people in developing countries. The engines of this transformation have been the faster transfer of knowledge and technology among countries, financial integration, surging trade and cross-border investment.

However, the IMF is not alone in recognizing the growing disillusionment with globalization. The period of sluggish growth that followed the financial and economic crisis uncovered the main challenges facing globalization, including the stagnation of incomes of middle and low-skilled workers in the industrial countries and the sharp rise of socio-economic inequality across the world. This has led to the rise of populist political forces that call for a return to inward-oriented policies, protectionist trade practices and limitations on immigration. Such policies are personified in President Trump, who seems to consider international trade and financial agreements in broadly negative terms, as instruments that allow other countries to take unfair advantage of the United States.

The IMF argues that the net impact of protectionism on the world economy is negative, leading to the disruption of international economic linkages. In good time, the disruption in trade and investment flows and the fragmentation of global logistic chains would lead to below-potential growth and productivity. In crisis times, the lack of global coordination and cooperation would weaken the resilience of the global economy and magnify the negative impact of shocks to the system.

In order to reverse the negative socio-economic impacts of globalization and promote faster global growth, the IMF report calls for more supportive fiscal and monetary policies—a 180o shift for the IMF away from the austerity policies promoted few years ago. These polices include fiscal stimulus, expansive infrastructure spending, increased resources directed to social programs and expanded social safety nets.

A reversal on globalization would be a lose/lose situation. Instead, the IMF is recommending the strengthening of the open and rule-based multilateral trading system, cooperation on maintaining global financial stability and resilience and cracking down on tax avoidance. The IMF message is global, but it is clearly aimed at the United States and President Trump. So far, the president has not acted on his campaign promises in this regard. In fact, you could argue that he has reversed course on a number of key global trade and currency issues. The IMF message is an attempt to convince his administration to maintain the U.S leadership in the prevailing global economic order.

[1] “World Economic Outlook”, April 2017