IMF: The Global Economic Recovery is on Solid Ground

posted by Karim Pakravan on July 27, 2017 - 12:02pm

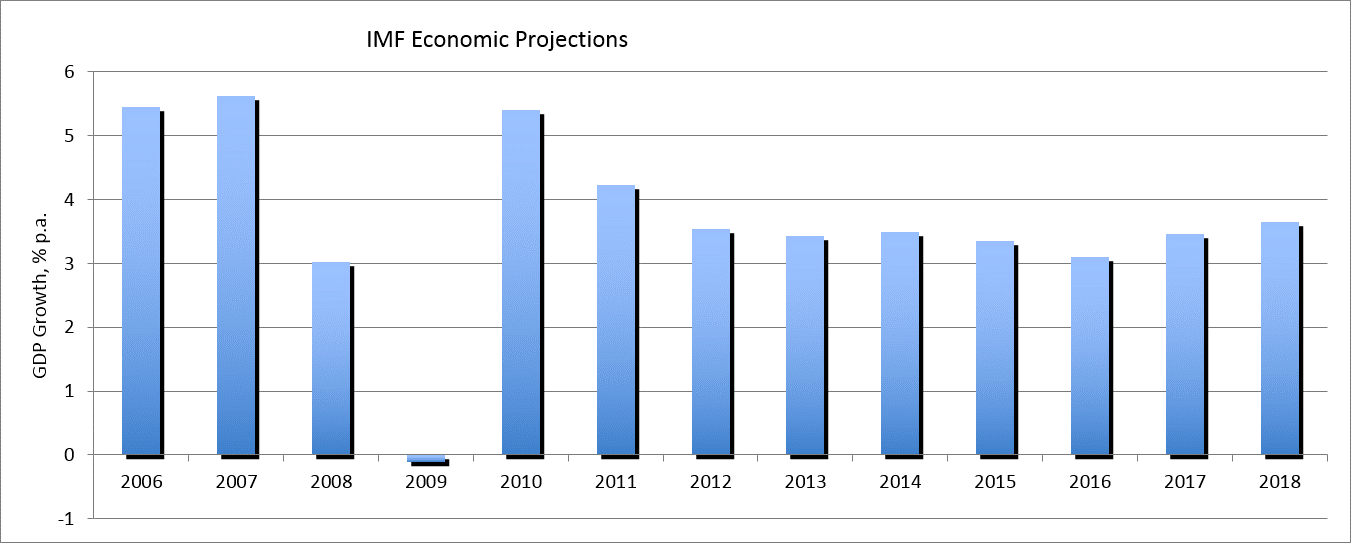

The IMF’s message in its latest global economic forecasts (World Economic Outlook, 7/24/2017) is broadly unchanged from its April version. The global economic recovery is gaining momentum and broadening in 2017, after a two-year slowdown. Global output is expected to grow by respectively 3.5% and 3.6% this year and next. However, the IMF states that the projected composition of growth will be slightly different, with slower-than-anticipated growth in the United States compensated by faster growth in the eurozone, Canada, Japan and emerging markets.

Table 1: IMF Economic Projections, July 2017

| Economic growth (GDP, %) | 2016 | 2017 | 2018 |

| World | 3.2 | 3.5 | 3.6 |

| G-7 | 1.7 | 2.0 | 1.9 |

| USA | 1.6 | 2.1 | 2.1 |

| eurozone | 1,8 | 1.9 | 1.7 |

| Emerging Markets | 4.3 | 4.6 | 4.8 |

| China | 6.7 | 6.7 | 6.4 |

As far as the IMF is concerned, there are two major changes since its April report. First, prospects for growth-friendly policies in the United States have faded as policy paralysis has overcome the Trump Administration and the Republican-dominated Congress. Second, the ill-timed British election has undermined the likelihood of a smooth Brexit, leading to a sharp decline in business and consumer confidence and a broadly weaker UK economy (the latest GDP release for the UK shows a sharper-than-expected slowdown in the first half of 2017). More broadly, the shift from austerity to an expansionary policy stance by the major economies is happening at a slower pace than earlier expected. The IMF considers that the risks are balanced in the short-run, but shifting somewhat to the downside in the medium term. In particular, the IMF is concerned about an excessive pace of monetary tightening by the major central banks and the potential for greater trade tensions. In this context, the IMF has warned the European Central Bank about the risks of an early exit from quantitative easing.

Fig. 1: IMF-Global Economic Growth

The broadly positive IMF report should be tempered by a number of considerations. First, while the eurozone is in the midst of a strong cyclical upswing, some of the structural issues of the eurozone remain unresolved. Among others, we can cite the Greek debt crisis, the massive external imbalances between Germany and other eurozone members, and the still very high level of unemployment. Second, the medium-term impact of the simultaneous balance sheet normalization by the major central banks on financial markets is unclear. Third, the deepening political chaos in Washington does not bode well for the development and implementation of coherent economic policies. Fourth, while the markets have so-far shrugged off geopolitical risks, there is a real danger of expansion of old conflicts and the emergence of new conflicts in both the Persian Gulf and North Korea, with major implications for oil markets and the U.S and global economy.