How to Escape the Vicious Circle of Declining Potential Output

posted by Karim Pakravan on June 12, 2017 - 2:48pm

The latest Bloomberg survey of 44 economists indicates that none of them are boosting (from 31% in the previous survey in March) their economic growth projections in the past month based on the assumption that the Trump administration will fulfill its economic program. Furthermore, 27% have cut their forecast and 73% stated that any movement (or the lack thereof) on the administration’s economic promises has had no impact on their forecasts. This survey stands in contrast to the “magical thinking” of the administration and its allies, who claim that the tax cuts proposed in the recent OMB one-pager would boost growth to 4%.

The pessimism of the aforementioned economists is fully justified, and there are structural reasons for the mediocre economic performance of the past few years. The 2008 financial crisis resulted in the worst recession in the United States since the Great Depression. The so-called Great Recession was brief, but brutal, with GDP falling by 4% between the end of 2007 and mid-2009. Since then, the U.S economy has enjoyed 8 years of steady, but slow economic growth averaging 2.1% per quarter on an annualized basis, from a 3.1% average in the two preceding decades.

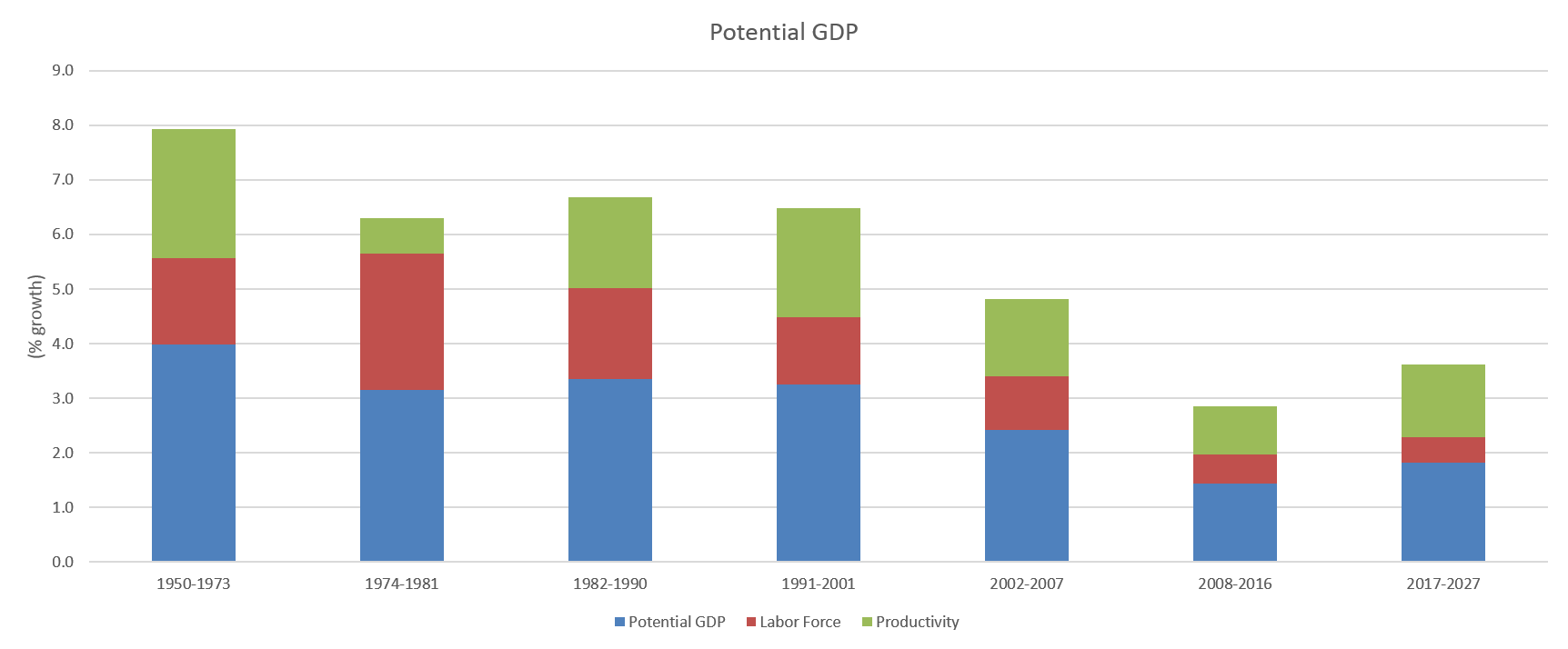

Fig.1: Potential Growth and its Components

A 1% drop might seem inconsequential, but the gap in growth builds over time. For the United States, for 2010-2016 period, it represents a lost output of almost $1 trillion, or 8% of GDP. This phenomenon has been repeated globally, with a secular decline in the rates of growth of both advanced and emerging market economies, and has been dubbed the “New Normal” by Mohamad el-Erian and “Secular Stagnation” by Larry Summers. In both cases, the economy is in an extended period of low growth, high unemployment and disinflation or outright deflation. In addition, these factors usually worsen the trifecta of inequality (income, wealth and opportunity). In the Secular Stagnation scenario, the economies are faced with the persistence of a high propensity to save and a low propensity to invest, leading to a drag on demand, reduction in growth and disinflation or deflation. In this case, conventional monetary policy measures are not equipped to pull the economy out of its rut.

However, financial crisis and the ensuing global recession only exacerbated trends that had been developing over the previous decade. In order to understand this discontinuity in economic trends, I propose to focus on a simple concept, potential economic growth. Potential growth is defined as the maximum rate of growth of the real GDP that is sustainable without causing inflationary pressures. In effect, the relative economic stagnation that we have seen in the past few years has been the result of a decline on the potential rate of growth.

In simple terms, the potential rate of growth is the sum of the growth in the labor force and the growth in productivity. Let us examine each of these in turn. We need to see what happened to both of these variables.

In the 30-40 years following World War II, the United States and the advance industrial countries enjoyed an unprecedented surge in growth, resulting from rapid growth in both labor force and productivity. Labor force growth was fed by the post-war baby boom and the rapid increase of female participation rates in the labor force, while productivity was surging as a result of high levels of public and private investment, innovation and rising levels of education.

Labor productivity increased an average of 2.4% per year in 1948-1973 period, 2% in 1991-20001, 1.4% 2002-2207, but only 0.9% in the 2008-2016 recovery. There are a number of factors at play: supply side headwinds, the evolving nature of technological progress and underinvestment in both basic science and capital. Robert Gordon, a Northwestern University economist, subscribes to a techno-pessimist view: the IT revolution of the 1990s and beyond did not live up to its hype, and had less impact than the previous innovations—electricity, chemical and pharma, the internal combustion engine, urban sanitation and communications. While this might be too pessimistic of a view, it is the case that the wave of technological progress that followed the 1990s internet and dot.com boom had a much bigger impact on productivity that the wave of the 2000s, which focused more on lifestyle and social media.

Furthermore, productivity does not come from great innovations per se, but their diffusion, exploitation and refinement. Finally, technological progress is not possible without a robust investment in basic science. Other factors could have been at play, such as the financialization of the US economy, with increased resources diverted to activities such as trading, derivatives, and financial engineering

The decline in productivity growth is closely intertwined with the structural problems in the labor supply of the past decade. The data shows that the slowing down in the growth of the labor force started much before the 2008 recession. The labor force grew by an average of 1.7% per year in the 1990s, 1% in the 2001-2007 period, fell during the recession and rose by an average of only 0.6% since. Moreover, the overall labor participation rate fell peaked in 2000 at 67% of the population, falling to under 63% after the recession. The male participation rate peaked in the mid-1990s at almost 70%, and fell sharply after the recession. The female participation rate peaked later, in 1999, at 60%, but fell to 56% by 2015. The recession had a much sharper impact on the men’s participation rate. Demographics were at play, as the aging baby boomers started retiring in the early 2000s, a loss only partly offset by immigration. However, the reduction in the labor participation rate goes beyond the graying of the population. We can cite globalization and the loss manufacturing jobs, as well as skills mismatch in the new technology-driven world, and falling investment in human capital. This trend worsened during the Great Recession at both ends of the age distribution. Extended periods of unemployment erode the skills of older workers, making it more difficult to reenter the labor force. Difficulties in finding jobs keeps the younger generations out of the labor force for longer period. Widening inequality, which is tied closely to a widening education and opportunity gaps, exacerbated these trends, as lower-skill displaced workers jut gave up and quit the labor force. Finally, post-recession fiscal austerity at both the federal and the state and local level devastated much needed investments in human capital (education and social service budgets).

What is to be done? The supply-side basis of the Trump administration’s economic program has been discredited a long time ago. Massive tax cuts could provide a short-term Keynesian stimulus in the short run, but will have little impact on potential growth since the problem stems from both low productivity and weakness in the labor supply. What we need as a country (and a world) is imagination and thinking out of the box: investment in infrastructure and human capital, as well as in basic science, encouragement of business formation and innovation through targeted deregulation. Such an approach would not only boost both labor participation and productivity, but would be the best way to reverse the challenging socio-economic inequalities that plague the more advanced economies.