The Greece Crisis and Eurozone Insanity

posted by Karim Pakravan on March 9, 2017 - 9:52am

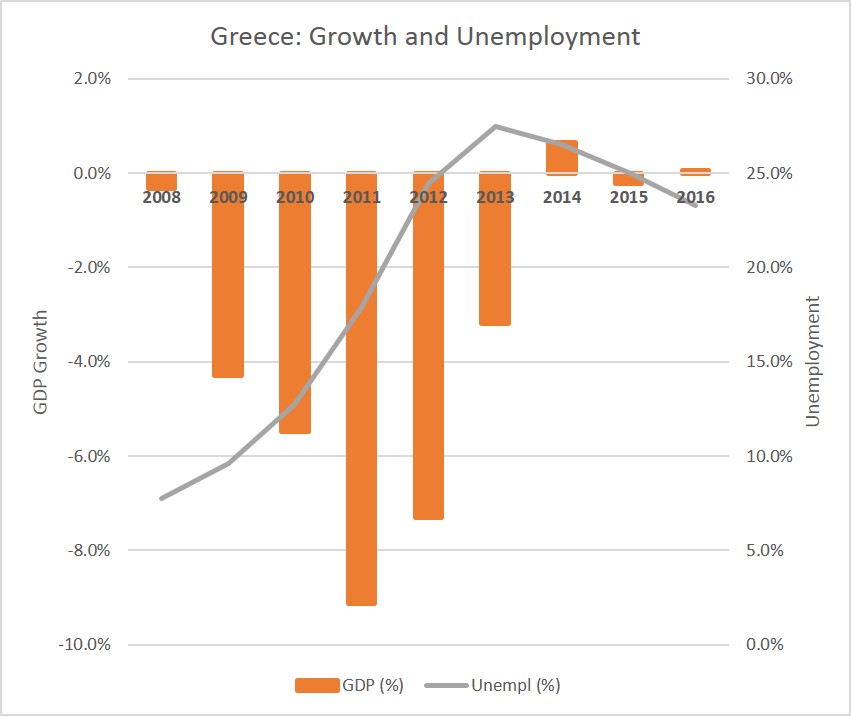

According to a quote attributed to Einstein: “Insanity is doing the same thing over and over again, and expecting different results”. By this measure, the Eurozone is insane in its approach to the Greek debt crisis. Once again Greece is in the headlines, once again for all the wrong reasons. Greek GDP contracted by 1.2% (quarter-on-quarter) in the fourth quarter of 2016, its eight decline in the past 16 quarters (Fig.1. ) Moreover, there are serious doubts about the ability of the Greek government to meet €5.5billion of debt repayments to the Eurozone creditors and the European Central Bank (ECB) without a further disbursement of funds from the country’s “troika” of lenders (the Eurozone, the ECB and the IMF). Furthermore, there are strong disagreements between the IMF on one side and the Eurozone governments (led by Germany) on the other about the sustainability of the present conditions.

Fig.1: Greece Economic Indicators

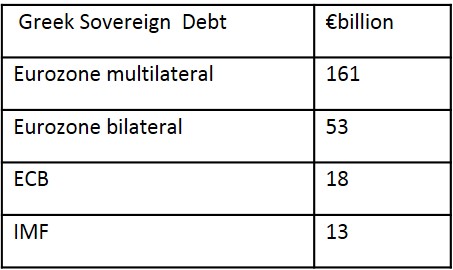

Since the onset of the Greek debt crisis in 2010, Greece has had three bail-out packages from the troika. Each package came after the recognition that the previous one was not working. Currently, Greece owes €192 billion to the troika, as follows [1]:

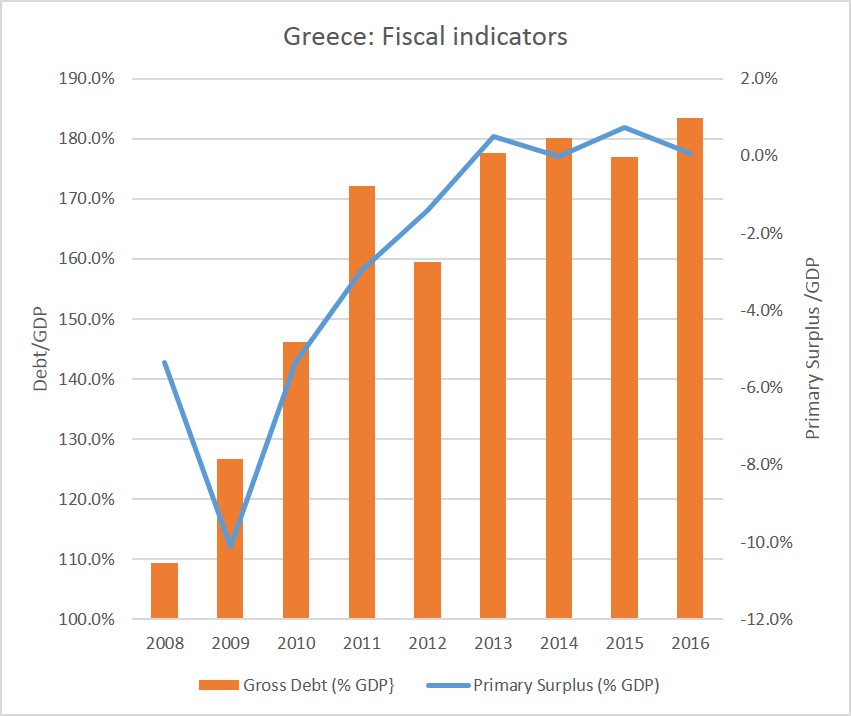

The latest bailout package, totaling €68 billion, was put dates back to 2015. These bailouts were accompanied by tough conditions, which imposed severe austerity measures on the Greek government. In particular, the troika lenders required that Greece stabilize its debt (in relation to GDP) by adopting a 3.5% of GDP target for its primary surplus (fiscal deficit ex interest payments). However, as can be seen in Fig.2, the Greek government was unable to ever get close to that target. This would have been obvious to any observer, since the severe austerity measures pushed the economy into a severe recession which has led to a surge on unemployment to close to 25% and reduced per capita GDP by 40% since 2008. The vicious cycle of austerity, lower growth and further fiscal austerity led the government debt to balloon from 125% of GDP to 184% from 2009 to 2016.

Fig.2: Greece Fiscal Indicators

This does not meant to exonerate the Greek government. Decades of economic management, creative fiscal accounting and a lack of economic reforms has led to this situation. We should remember that it was the newly elected Greek government itself who in 2009 revealed the degree of fiscal manipulation of its predecessors, precipitating the crisis.

The IMF seems to have come to its senses, but not the Eurozone. In its latest assessment of the Greek situation, the IMF has flatly stated that the 3.5% target cannot be met, that the current path of the Greek debt has stopped being sustainable a while ago, and that there needs to be an 180o change of direction in the bail-out conditionality. More specifically, the IMF is recommending to reduce the primary surplus target to 1.5% of GDP, and more importantly, to shift the focus of fiscal policy from austerity to a growth-friendly one, with an emphasis on tax cuts and spending increases.

So far, the Eurozone and the IMF remain at odds over the Greek program. The IMF and the Eurozone leaders were unable to reach agreement at the last “Eurogroup meeting” on February 20th. Given the continued deterioration, a compromise could be possible at the next troika meeting on March 20th.

However, it must be recognized that any agreement, even one that loosened the austerity straitjacket on Greece, would be a band-aid. We only need to go back in history and review the emerging market financial crises of the 1980s and 1990s to recognize that the only true solution is deep debt relief. The Eurozone should give up its irrational sanctification of debt and fiscal rectitude. Greece must be able to grow out of its debt problem. Significant debt relief (a new Brady-like Plan) and new funding are necessary, but not sufficient conditions. The monies should be used to assist Greece to exit the euro, something that should have been done in 2010, before the waste of almost €200 billion.

The problem here is with timing. These moves would have been easier in 2010. Today, In particular, the main Eurozone governments, particularly the German, French and Dutch ones, are facing strong populist pressures and are unwilling to be seen as bailing out an “undeserving” country. However, Greece is a ticking time bomb. Without some form of relief and a release of the bailout money, the country faces a political crisis, early elections and potentially a default. In the meantime, throwing more good billions of euros after bad fits Einstein’s definition.

[1] In addition, the country owes $1.4 billion to private creditors.