Four Takeaways from the FOMC Meeting

posted by Michael Lewis on December 16, 2016 - 2:46pm

My Four Takeaways from This Week’s FOMC Meeting.

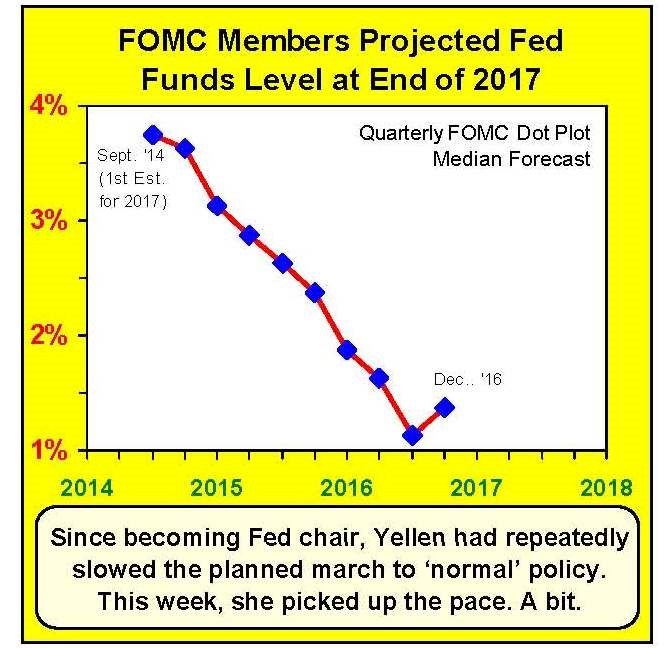

1. FOMC turns more hawkish, finally. From the moment Janet Yellen took the helm in January 2014, the FOMC has been growing steadily more dovish. Until this week, that is. The FOMC raised the funds target another +25BP, as expected, but the accompanying “dot plot” increased projected future tightening for the first time in more than four years.

The FOMC did raise the funds target in December 2015, but that was far later and far less than had been envisioned when Yellen was sworn in or while she served as vice-chair under Bernanke for that matter. Yellen’s dovish retreat is readily apparent in the quarterly “dot plots.” In September 2014, when the dot plot was extended to 2017, the members projected that the funds target would end that year at 3.75%. Every quarterly edition of the dot plot since then reduced that 2017 endpoint, sometimes by as much as half a point; the 2017 plan bottomed out at just 1.125% this past September. After this week’s meeting, the funds target projection for 17Q4 is up to 1.375%.

Whether this truly marks a change in direction/attitude or whether Yellen & Co. can even follow through on the current far-from-hawkish intention remains to be seen. It is a start.

2. The markets and the FOMC are aligned, finally. During Yellen’s tenure (and before), fed futures consistently scoffed at the FOMC’s resolve to tighten policy. The markets were right to price in only very limited tightening. After this week’s meeting, however, the FOMC and markets are on the same page. The median FOMC dot plot shows three more +25BP rate hikes in 2017, and fed futures are pricing in +60BP of tightening, or about 2.5 rate hikes, next year.

Has Yellen restored the Fed’s credibility? Perhaps, though FMI thinks the futures market share our view that higher inflation will give the FOMC no other choice. If it takes longer for inflation to perk up, Yellen will likely balk again.

3. FOMC is lying shading the truth about inflation. While the FOMC shifted in a more hawkish direction, the members’ economic forecast was virtually unchanged -- the same okay +2% real growth and stable jobless rate near 4.6% over the three-year forecast horizon. Of special note, the FOMC continued to argue that core inflation would remain just barely below their +2% target through 2019. FMI disagrees, and we suspect that the FOMC is far from convinced.

Granted, inflation has been under +2% for a long time. Yet, prolonged ultra-easy policy inevitably generates inflation pressures. There is ample evidence, in wages (data which Yellen particularly follows), housing prices and elsewhere that such pressures are building.

By insisting that inflation will not breach the target, FOMC members put off uncomfortable questions about why policy remains so accommodative when dual mandate goals have been met. We believe that members want to raise the inflation target to foster their strategic goals, namely a steeper, more normal yield curve and hence higher long rates. Once inflation does start trending above +2% -- which we believe will occur by mid-2017 -- the FOMC will have to abandon their magical thinking by either raising the inflation target or by agreeing to tolerate higher inflation “for a while.”

4. The surge in long rates enabled FOMC’s hawkish turn. Between the September and December FOMC meetings, the FOMC economic and inflation forecasts were unchanged; neither the data nor the outlook provided reasons for the FOMC to step up projected future tightening. Trump did win the election, which we doubt Yellen expected. That, however, is likely only a minor factor (any successes Trump has in stimulating the economy or failures threatening it will take a while to manifest).

The big difference from September and the main motivation for the FOMC’s new more hawkish stance was the surge in long rates, e.g., the +80BP increase in the 10-year yield.

This, we believe, was what the FOMC wanted, though it is undoubtedly more of an increase than they had expected at this point. FMI has argued that the FOMC’s emerging strategy is to steepen the yield curve to more ‘normal’ levels. This would alleviate stresses on the financial system and, they believe, give them more time to return to a neutral policy.

To that end, the FOMC would encourage higher long rates by promoting/tolerating higher inflation, even exceeding the official +2% target. (The Bank of Japan, we note, has already begun to pursue a similar strategy; other central banks will likely follow).

The increase in long rates is not a problem -- rates are still not high enough to impede economic activity. Consequently, the FOMC saw a free pass to squeeze in a bit more projected tightening, and they took it.