Emerging Markets on the Cusp: Part Three - Emerging Markets Debt Crisis or Resolutions??

posted by Karim Pakravan on September 14, 2022 - 11:14am

This article is the third of a series about the challenging global environment facing Emerging Markets/Developing Countries (EM/DCs) living with the legacy of the pandemic and the Ukraine war. In this series, we want to apply the techniques of Country Risk Analysis to assess the changing risk environment, especially as it applies to a potential debt crisis.

The first article, The Past as Prologue, focuses on the parallels between the first major debt crisis of the 1980s and the situation today. The second one, Emerging Markets and Global Risks, deals with the challenging environment facing the EM/DCs. The final one-"Emerging Markets Debt: Crisis or Resolution?" will analyze the risks of another global debt crisis affecting EM/DCs.

As discussed in the previous post, emerging markets and developing countries face an unprecedented set of risks: a sharp slowdown in the global economy, a sustained tightening of monetary policy in the United States, the European Union and the UK, sharply higher interest rates, a strong dollar and widening bond spreads, soaring commodity and energy prices and a reversal of capital flows. The question is whether or not these risks, amplified by geopolitical risks, will lead inexorably to yet another EM debt crisis.

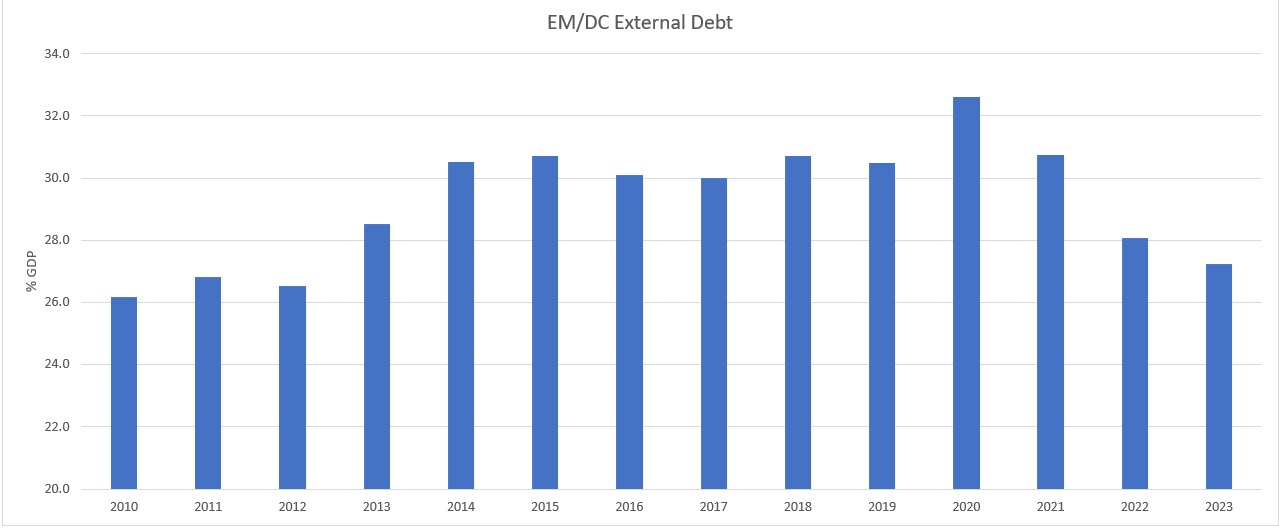

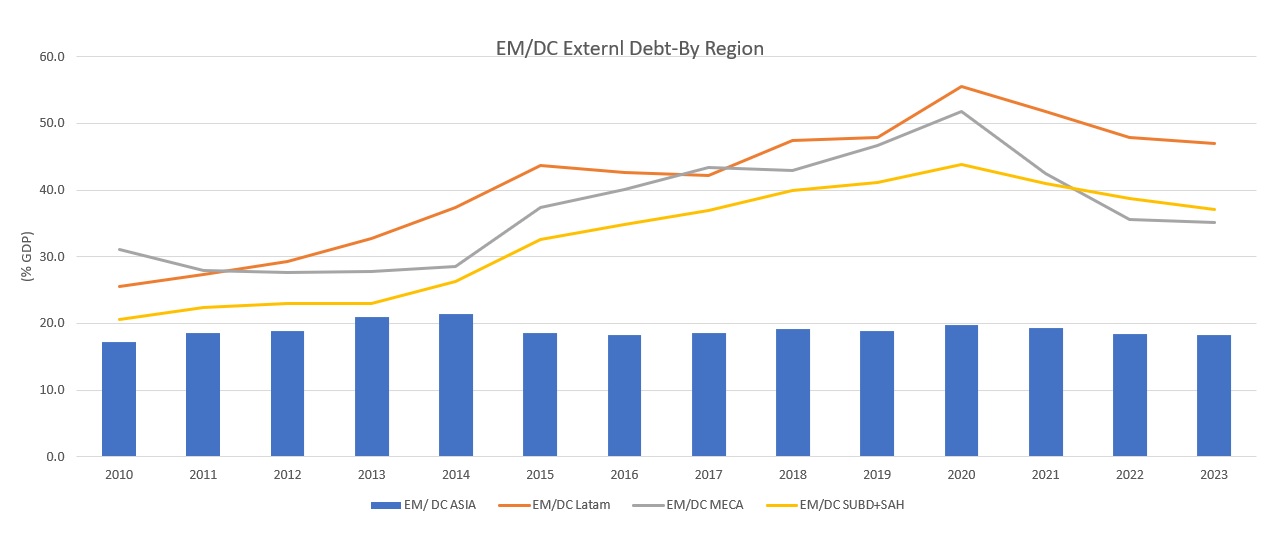

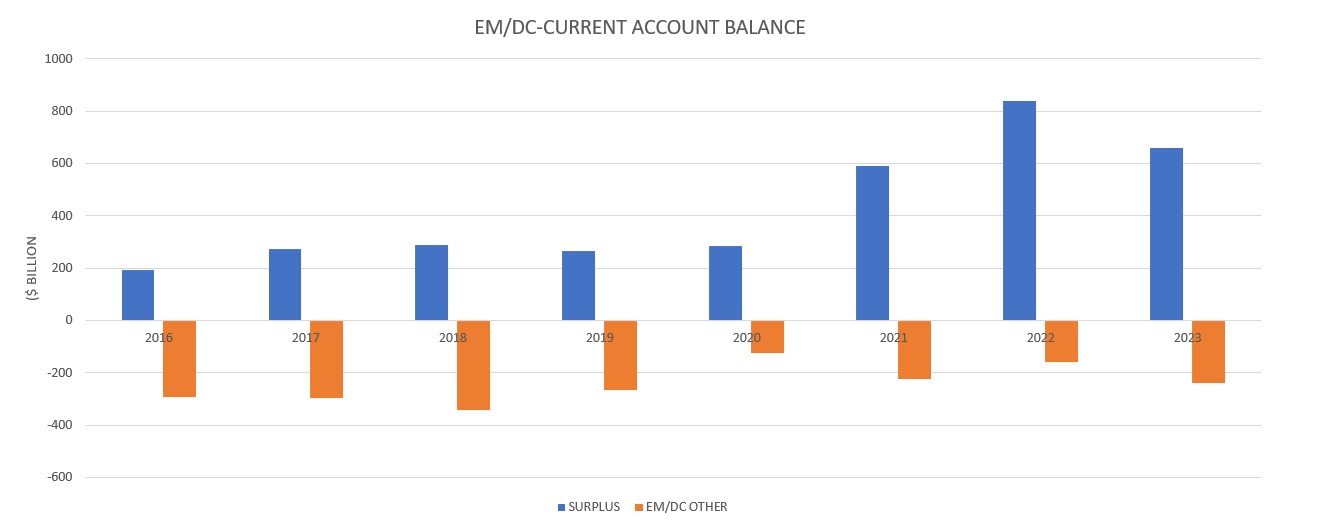

Since the Asian crisis of 1997, the world has not experienced any systemic debt crises. Moreover, as discussed in the first article of the series (“Past as Prologue”), EM/DCs face a very different set of circumstances: more robust policy framework, globalized financial and capital markets, diversified sources of funds/creditors and instruments, and a comfortable cushion of foreign exchange reserves. Moreover, the level of external debt relative to GDP has remained low at around 30% in the past decade. Foreign exchange reserves, (excluding the major Arab oil producers and Russia), are comfortable. The current account deficits are also manageable. The key issue is that there is a large degree of differentiation in the universe of EM/DCs. In fact, the very designation of EM has become obsolete for the upper middle income/diversified countries in that universe.

A Diverse Debt Universe: In what follows, I will argue that, because of this differentiation, the world does not face a debt crisis, but rather a series of debt events concentrated in a number of low income countries. We can classify the EM/DCs in three distinct groups: Emerging Markets (EMs), large commodity exporters-especially petrostates), and low income/energy and commodity importers. For the most part, what we characterize as the EM world should be able, with a few exceptions, to withstand the strong crosswinds of the global economy. Large commodity exporters, especially the Arab members of OPEC and Russia, were initially hit by the collapse in oil prices early in the pandemic. However, they have benefitted from the sharp rise in oil prices resulting from both the global economic recovery and the Ukraine crisis. Other EM commodity exporters have also benefited from the commodity boom of the past two years. China, while classified as an EM by the IMF, is in a class of its own with a strong external position and massive external reserves.

The last group, the low income/energy and commodity importers, have been hit the hardest. This group of countries has had limited access to global financial markets, have limited foreign exchange reserves and are heavily dependent of official bilateral and multilateral financial flows. They were severely impacted by the pandemic, global inflation, the strong dollar and the surge in energy and food prices in the past year. In order to help these countries financially, the G20 countries and the multilateral financial organizations agreed to suspend the debt service under the Debt Service Suspension Initiative (DSSI) in 2020-2022. In addition, the G20 agreed to a “Common Framework” in November 2020 to facilitate the rescheduling of the external debt of these countries. Overall, the IMF has programmed up to $650 billion since the COVID crisis to assist low income debtors. The IMF estimates that of the 61 countries in the DSSI, 41 are at “high risk” and another 20 face “significant problems”. However, so far a few countries (Sri Lanka, Zambia and Lebanon) have actually defaulted, Zambia has already an IMF program, and Pakistan has applied for one. However, only a few countries have applied for help under the Common Framework.

The China Factor: An important element of the global financial scene is that China has emerged as an important player in the global debt issue. Asa result of its Belt and Road Initiative (BRI) and other infrastructural programs, China is now de facto the biggest bilateral official creditor to the DSSI countries. China’s share of exposure to low income countries rose from 2% in 2006 to 18% in 2020The BRI program covers 148 countries, most of them in the higher risk categories, with a total exposure of over $800 billion. Given the political and strategic characteristics of the BRI program—which is designed to project China’s economic, political and eventually military power across the globe—the loans were often extended without consideration to their riskiness. Moreover, much of these loans were secured by projects as collaterals, and China proved to be a ruthless enforcer of loan terms, often seizing the project in the face of non-payment. The BRI is facing its first debt crisis, being forced to renegotiate respectively $16 billion and $32 billion of the loans in 2018/19 and 2020/21, totaling about 16% of the portfolio. Despite efforts by the Paris Club and multilateral banks, China has so far stayed aloof from the existing bilateral and multilateral debt relief framework and agree to a collective approach to the issue.

Hard choices: The DSSI is due to expire at the end of 2022, Even with some relief in the shape of lower energy and food prices, the low income countries will face severe pressures, including food shortages, high inflation and large external deficits. Ultimately, they will have to choose between servicing external obligations or importing essentials--a political as well as an economic challenge to their stability. In the short and medium term, finding a coordinated solution to the global financial difficulties and avoiding a debt crisis is an essential task for advanced countries’ governments, as well as for the multilateral organizations. Coordinating such a response in a deeply divided international community might be difficult. In the longer term, rethinking the approach to analyzing the risks facing the global financial system is the task at hand.