Currency Wars: Back to the Future

posted by Karim Pakravan on July 16, 2019 - 3:33pm

The Trump administration’s zero-sum approach to international relations is now spilling over from trade to currency wars. After spending the best part of his 2016 campaign and the first three years of his presidency railing against foreign countries taking advantage of the United States on trade, Trump and his administration have started complaining in the past few months about currency manipulation. In doing so, it is bringing us back to the 1990s, or even the 1930s.

What is currency manipulation? Basically, it is intervention in the currency markets by selling or buying foreign currencies (in effect the dollar) to achieve a desired exchange rate that would not be achieved by letting market forces work. Generally, it involves the country buying dollars to weaken the exchange rate to the dollar in order the gain a competitive advantage.

We should start our discussion with a brief currency regimes’ history. World War I and the Great Depression on the 1930s effectively ended the Gold Standard. During the 1930s, Countries engaged in a futile sequence of competitive devaluations (aka Beggar-thy-Neighbor policies), policies which contributed to the collapse of world trade. Following World War Two, dollar-based fixed exchange rates emerged in the context of the Bretton Woods system. The Bretton Woods agreement, which also established the International Monetary Fund and the World Bank, was designed to promote both exchange rate stability and global economic integration. President Nixon ended the Bretton Woods system by severing the dollar-gold link in 1971 and by letting the dollar float in 1973. In turn, this led to the currency regime in place since that time--managed floating exchange rates. Countries frequently intervened in the currency markets, the main example being Japan in the late 1980s and early 1990s. However, the surge of the dollar in the 1980s was a concern for the major countries, which led to the Plaza Accord of 1985 between the United States, Japan, Germany and the UK, allowing for a significant weakening of the dollar against the major currencies. Following Plaza, the persistent dollar weakness led to a second agreement between these same countries—the Louvre Accord of 1987-- designed to prevent a further weakening of the dollar. Since then, however, the major countries have moved to freely floating regimes. In the 2000s, the focus shifted to China, and its seemingly undervalued currency. After July 2005, China revalued its currency and shifted from a fixed exchange rate regime to a managed float, leading the United States and other major countries to frequently accuse China of currency manipulation.

Fast forward to 2019. The Trump administration has complained bitterly, once again without either understanding the economics of the foreign exchange markets or any tangible proof, that countries ranging from China to Japan and Germany are gaining unfair trade advantage by manipulating their currencies. Most recently, he attacked the European Central Bank (ECB) for deliberately weakening the euro by shifting to a more dovish stance. While the latest Treasury report (May 2019. The U.S. Treasury’s recently released its latest currency report (https://home.treasury.gov/system/files/206/2019-05-28-May-2019-FX-Report...) , amplifying the Trump line by putting nine countries on its “Monitoring List” --China, Germany, Ireland, Italy, Japan, Korea, Malaysia, Singapore, and Vietnam. As we will show, this statement is belied by the data. Furthermore, it is puzzling that the report singled out some eurozone member nations, which shows either ignorance or willful manipulation of the facts. Obviously, the eurozone monetary policy is controlled by the ECB, not by any single country, and the exchange rate applies to all eurozone members.

Let’s look at the facts.

· Since its recent peak at the beginning of 2018, the euro has weakened by 10% against the U.S. dollar. The yen has strengthened by 10% over the same period. The Chinese yuan has been stable for the past year against the dollar. Moreover, the Chinese central bank has been selling dollars for the past few years to prevent the yuan from weakening further.

· The dollar index (DXY) has strengthened by 1% in the past six months, but has lost 7% since Trump became president.

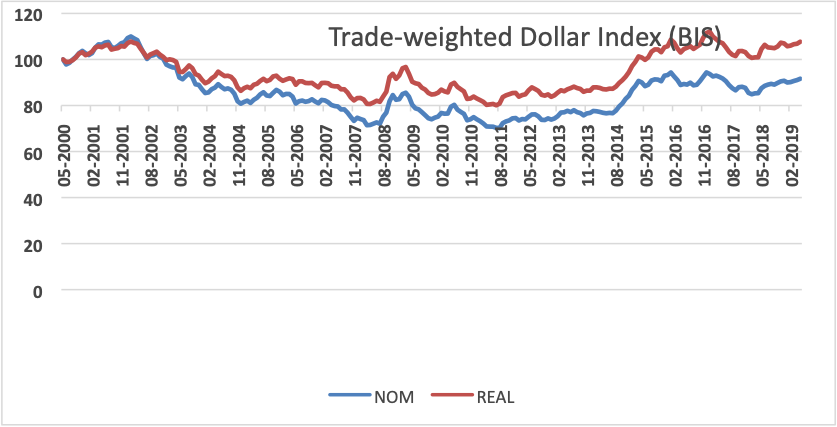

· According to the Bank of International Settlements (BIS) data on trade-weighted currency values, the dollar has gained respectively 3.6% and 7.9% in nominal and real terms since mid-2014, but has essentially been stable since mid-2015

Judy Shelton, one of Trump’s prospective nominees to the Fed Board of Governors and an ardent gold standard supporter, has argued in a recent Op-ed piece in the Washington Post that the Fed should also work to stabilize the dollar—in essence proposing a managed currency. Apparently, Shelton has not heard about the “Impossible Trinity” principle, a concept learned in any introductory international finance class. This principle states that a central bank cannot achieve simultaneously more than two of the following policy goals: interest rates stability, free movement of capital and exchange rate stability. Most major central banks have wisely abandoned exchange rate stability as a policy goal, focusing instead on domestic issues.

The Trump administration’s focus on threatening fire and fury in bilateral international relations issues (be it trade or currencies) misses the big picture.

· The main reasons for the United States running a large external deficit are strong internal demand and low savings relative to investments. In particular, the surging fiscal deficit resulting from the ill-conceived massive tax cut of 2017 and spending boost of 2018--estimated at $1 trillion this fiscal year—are a major contributor to the external deficit.

· The relative strength of the dollar is also fed by the inflow of capital into the U.S. attracted by higher interest rates and the dollar “safe haven”. Paradoxically, the more Trump destabilizes the global system by his threats, tweets and generally inconsistent policies, the strong these inflows and the stronger the dollar.

Going back to a beggar-thy-neighbor policy /currency interventions will only increase global tensions, but do very little to resolve the U.S. external imbalances.