COVID-19, Emerging Markets and the IMF

posted by Karim Pakravan on July 5, 2020 - 4:45pm

COVID-19 has pushed to global economy in a synchronized and deep downturn of apocalyptic proportions, with combined supply-side and demand-side shocks devastating economies across the world. In the words of Gita Gopinath, the Chief Economist of the IMF, “A crisis like no other”.

According to the latest IMF World Economic Survey, even with a partial recovery in the second half of the year, the global economy is expected to shrink by 4.9% in 2020. Moreover, these projections are subject to unprecedented uncertainty, depending on key assumptions about the future path of pandemic and the shape of the pattern of the eventual escape after a vaccine has been developed and widely distributed.

Both the economic impact of the pandemic and the policy response have been unprecedented. The downturn was abrupt and global, with output dropping by 25-40% in a single quarter staring in mid-March across the globe. Moreover, governments responded on an unprecedented and massive scale, with an aggregate $10 trillion in fiscal stimulus and $6 trillion in monetary measures to prevent an even deeper economic contraction.

Even with a strong recovery in the second half of 2020, the IMF expects global output to be $12 trillion lower than the projected pre-pandemic 2020 level. However, most of the policy responses have occurred in the advanced countries. With all the focus of the media on the advanced economies (AE), in particular the G-7, it is easy to forget that the emerging market (EM) countries have been deeply affected by the pandemic. Moreover, these countries suffer from structural weaknesses which has made the trade-offs between pandemic containment and macroeconomic mitigation more difficult and problematic than for the AEs. In particular, they do not have the public health infrastructure or fiscal and monetary resources of the advanced countries to counter effectively the COVID-19 crisis. As such, they are expected to suffer disproportionately and recover more slowly.

In addition of the dual demand and supply shocks caused by lockdowns and other disruptions, emerging markets have been also adversely affected by the following COVID-related factors:

· A collapse in commodity prices. Oil prices (Brent) collapsed to near zero in March, and have recovered to only around $40/barrel, about 3O% lower than their average 2019 levels. In addition, oil producers have been forced to cut production drastically—OPEC is at its lowest crude output level since 1991. Other commodities have also suffered significant price declines, with the Bloomberg Commodity Index down 18% in 1H20.

· Spillovers from the global contraction in demand. Global trade is expected to decline by 11% in 2020. In addition, many emerging countries have seen their output sharply cut as a result of the disruptions in the global supply chains.

· A sharp reduction in worker remittances, a major source of foreign currency income, as well as employment for many emerging markets. The IMF projects that remittances will decline by about $100 billion (30%) this year relative to 2019.

· Emerging markets are also constrained in their policy responses. Despite many years of reforms. EMs room for fiscal maneuver remains limited. As a result, the aggregate EM fiscal stimulus packages totaled 3% of GDP, in contrast to 10% for AEs. On the monetary side, major EM central banks responded by cutting interest rates, but once again were unable to replicate the AE central banks’ massive interventions in financial markets.

· As a result of the pandemic, hard-earned secular gains in poverty-reduction have been reversed, with an estimated 100 million people slipping back into poverty since the beginning of the crisis.

We have seen a variety of crisis policy responses in EMs. However, it is clear from the magnitude of the problem that what is needed is a global solution involving both bilateral and multilateral actors. The multilateral financial institutions (MLFs) such as the IMF and the World Bank, as well as global cooperation institutions such as the G-20 have played an important role in alleviating some of the economic and financial pressures on the emerging markets:

· The G-20 countries (which include all of the advanced countries and the major developing and emerging market countries) have agreed to suspend the debt servicing obligations of 73 of the poorest emerging markets and developing countries through the ed of 2020.

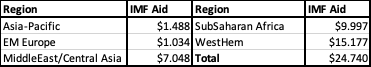

· The IMF has committed $24.7 billion in emergency financing to 69 emerging markets and developing countries since the beginning of the pandemic. In addition, the IMF has offered significant debt relief to the biggest recipients of IMF financial support—including Egypt, Nigeria and Pakistan. Furthermore, the IMF has also provided $35 billion in flexible lines of credit to Chile and Peru. The IMF has reversed its long-standing position on the need for austerity programs in exchange for IMF help. Instead, it has embraced the need for significant stimulus in order to mitigate the economic impact of the pandemic

· The IMF has also taken the lead in providing an integrated platform of global pandemic information and integration of epidemiological projections with traditional macroeconomic forecasts

Table 1. IMF Emergency EM Financing-March-May 2020 ($ billion)

In the short term, the financial situation of EMs has stabilized somewhat. EMs were initially hit by an estimated $80 billion capital outflow in March. However, external flows stabilized and capital started flowing back more recently as global investors started looking for yield in the higher rated EMs, with were able to raise $131 billion in foreign currency sovereign debt.

Nevertheless, the EM’s path to recovery remains difficult. Once again, even the best macroeconomic models cannot project a central scenario, given the tremendous uncertainties regarding the path of the pandemic. Many EM countries who were somewhat spared in the first few months are experiencing surges in the rate of infection, and the world has neither a cure nor a vaccine. Furthermore, the EMs will face a continuation of the current macroeconomic trends: sluggish global recovery, weak commodity prices, a collapse in remittances and revenues from tourism, a sharp decline in global trade and the disruption of the global supply chains.

Furthermore, while the global financial response to the EMs had helped mitigate somewhat the severity of the immediate economic impact of the pandemic, significant new financial resources will be required in the months to come to provide both liquidity and recovery funds. The IMF has committed itself to mobilize up to $1 trillion in COVID-19 response funds to EMs. The World Bank has committed to offer up to $160 billion in financial support--including $50 billion in low-interest/very long-term, through the International Development Agency (IDA)—over the next 15 months. Nevertheless, more will be needed, as it is estimated that EMs will face a financing gap of $2.5 trillion as a result of the COVID-19 crisis.

It is clear that the rapid and strong recovery medium-term recovery of the EM economies is an essential part of the global recovery from the pandemic. The AE (and G-20) governments will need to provide the additional funds needed by the MLFs to face the needs of EM countries. However, given the lack of clear global leadership from the West (in particular the United States) and the unraveling of the spirit of global cooperation, one can be excused to be skeptical about such an outcome. Nevertheless, in the absence of resources, the EM economic crisis will morph into yet another financial crisis,