China on the Rebound

posted by Karim Pakravan on January 11, 2018 - 9:38pm

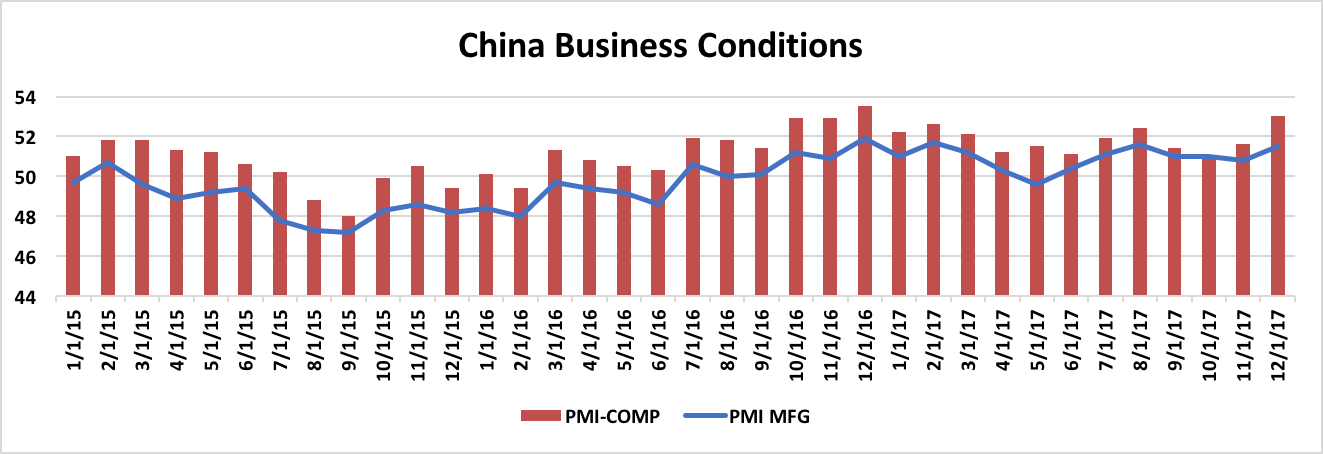

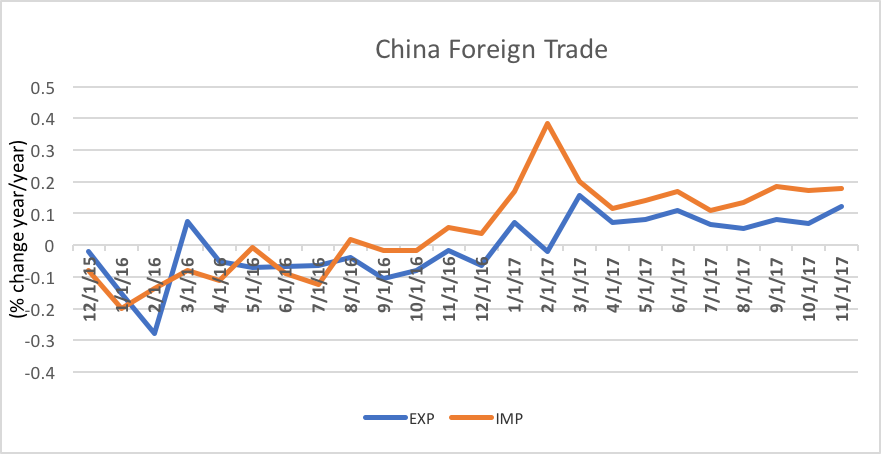

China’s main economic indicators underscore a stronger pace of recovery. The Caixin PMI indices have strengthened: the Caixin PMI-Manufacturing[1] increased to 51.5 in December, its highest level in four months, and the Caixin PMI-Composite jumped to 53 from 51.6 at the end of November. At the same time, a strong global economy has contributed to a recovery in external trade. Foreign trade is on a rebound since the end of 1Q17 (first quarter 2017) after several quarters of decline, with exports and imports for the first 11 months of 2017 rising by respectively 8% and 17.2% relative to the same period of 2016.

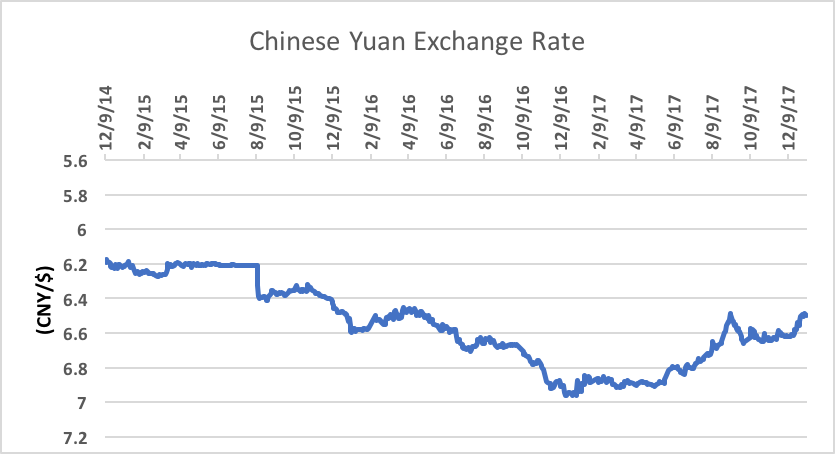

Foreign exchange reserves, which had declined by $844 billion between the end of 2014 and their low point of under $3 trillion in January 2017, resumed their upward trend, rising by $141 trillion in the course of 2017. Capital outflows (defined as current account surpluses minus changes in foreign exchange reserves) continued in 2017, albeit at a slower pace. These outflows totaled $255 billion in the first three quarters of 2017—and reached an aggregate of $2.2 trillion since the beginning of 2015. The Chinese yuan also recovered, gaining 6.9% against the US dollar in 2017.

China’s more robust foreign position comes at a time when President Xi Jinping is taking a much bolder stance in promoting China as the “other” superpower. Furthermore, with the United States under President Trump is retreating from its global leadership role, China is positioning itself as the guardian of a multilateral-based world order. This is reflected in the ambitious One Bridge-One Road (OBOR) initiative, aka the New Silk Road”, as well as the revival of the TransPacific Partnership abandoned by Trump under Chinese leadership, as well as massive amounts of investment and foreign aid in Asia, Africa and Latin America. How China’s new assertiveness will reshape the global financial architecture remains to be seen, and will be the topic of future posts.

[1] The PMI (purchasing managers’ index) is a forward-looking indicator of economic activity. Levels above 50 indicate an expansion, below 50 a contraction.