Central Banks Are Buying Gold. Should They Be Buying Bitcoin Instead?

posted by Lyric Hughes Hale on January 4, 2023 - 12:00am

TOWARDS A MODERN MONETARY POLICY.

If you think the case for central banks holding cryptocurrencies in their reserves is farfetched, think again. They are already making detailed preparations.

In December, the BIS (Bank for International Settlements), central banker to central banks, published a document Prudential Treatment of Cryptoasset Holdings. It provides detailed risk management guidelines for central bank holdings of two defined groups of cryptoassets including stablecoins. It will go into effect January 1, 2025. As far as is known, only El Salvador now holds Bitcoin in its reserves. However once regulatory guidelines become clear, major central banks will be able to add cryptoassets to their balance sheets as well.

The US government in fact is already one of the biggest holders of Bitcoin, with 214,682 coins, about 1% of world supply. Instead of selling them, as it has previously done at auction, the US treasury could instead transfer ownership to the Federal Reserve, adding about $3.6 billion to their balance sheet at current values. Over time, the Fed might even make a profit.

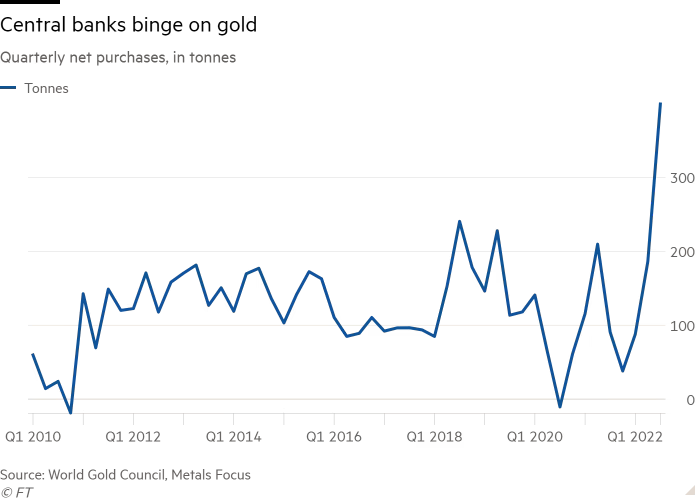

Recently, in the face of inflation and unprecedented sanctions against the Bank of Russia, some central banks have begun to buy gold. They are stepping back into the world of Bretton Woods, before President Richard Nixon abolished the link between the US dollar and gold in 1971, which had created a crisis.

Although young goldbugs do exist, cryptocurrency usage is generational. A majority, or 56% of Americans age 18-34 own some crypto, and 34% age 35-54, but only 9 % age 55 or older. Instead of moving back into the past, why not move forward towards an energy-based computational standard with a fixed supply such as Bitcoin? That would be more appropriate to what is valued in the 21st century. Moreover, linking to metals can be unpredictable. The supply, far from being limited, could be increased overnight by some new discovery or improvement in mining technology. Or even an errant meteorite.

What central banks should be doing instead of buying gold is buying what some dismiss and others fear. At current prices, it would only cost under $200B to buy 51% of the existing supply of Bitcoin. Of course, as soon as the market learned of an extensive buying program, the price would increase, just as the worldwide price of silver increased after the US Silver Purchase Act of 1934. But if done as a consortium, the CB’s would end up with a majority interest. I am sure that some crypto bros in San Francisco would be happy to help them achieve this.

The irony is that recent gold purchases by central banks might actually be tied to energy anyway, in this case oil, in order to evade US sanctions. Trust in international financial architecture has been eroded, especially in the Global South, so what are the alternatives? All currency creation requires energy. Physical gold requires mining, transaction, verification, storage, and security costs. By contrast, Bitcoin offers near-instant and low-cost transfers based on cryptography, the practice of secure communications in an adversarial environment. Which describes the world we live in today.

While doing research on China’s experience with the silver standard in the Interwar period, I discovered that Chinese banks used paper currencies verified by both a public (the bank) and a private (the customer) key more than 100 years ago. They did this rather than exchanging physical gold or silver. Paper money itself was invented in China to overcome practical problems with metallic currencies.

So how does owning crypto assets mesh with plans for central bank digital currencies, or CBDC’s? China has been at the forefront of this effort, conducting extensive pilots. However last week, Xie Ping, a former official of the People’s Bank of China disclosed that the results of these pilots have been disappointing in terms of uptake and usage. Perhaps that is because China already leads the world in digital transactions, nearly $4T vs $2T in the US, so in effect no problems are solved by a CBDC. And as in the US and elsewhere, they might be meeting resistance from retail banks.

With the demise of FTX, we have seen the schadenfreude of those who think they are now relieved of thinking about decentralized finance and that crypto will dissapear. What that debacle really proved is that any bank can be robbed. It is notable however that since the scandal was revealed, the price of Bitcoin has remained virtually unchanged. I expected more of a rout and less resiliency.

The adoption of cryptocurrencies in global finance is already here and cannot now be stopped. Younger people especially believe in them and almost take them for granted. Central banks would do well to figure out how to exist alongside these new assets, despite efforts by various countries including China and the EU to abolish them. Going back to a metallic-based currency regime that has already failed, with disastrous results multiple times throughout economic history, is not the way forward.

A future where legacy financial systems exist side by side with innovative new asset classes is the most productive path forward. The JFSA (Japan’s Financial Services Authority) is the single regulatory body governing crypto assets. The US would do well to follow Japan’s lead, and the BIS, and delay regulatory clarity no longer.

Please feel free to share this post, and contribute your comments. We welcome hearing from our readers! And if you are already a free subscriber, please consider upgrading to paid to support our work. Just click the subscribe button above to go to your account for details.