The Buenos Aires G20 Summit: A Preview

posted by Karim Pakravan on November 26, 2018 - 4:26pm

The G20 leaders gathering on November 30 in Buenos are meeting at a time of rising global challenges to the global economic and financial system: slowing global growth, rising trade tensions, attacks by the Trump administration on the global financial architecture, financial markets meltdown, regional disputes among key G20 members.

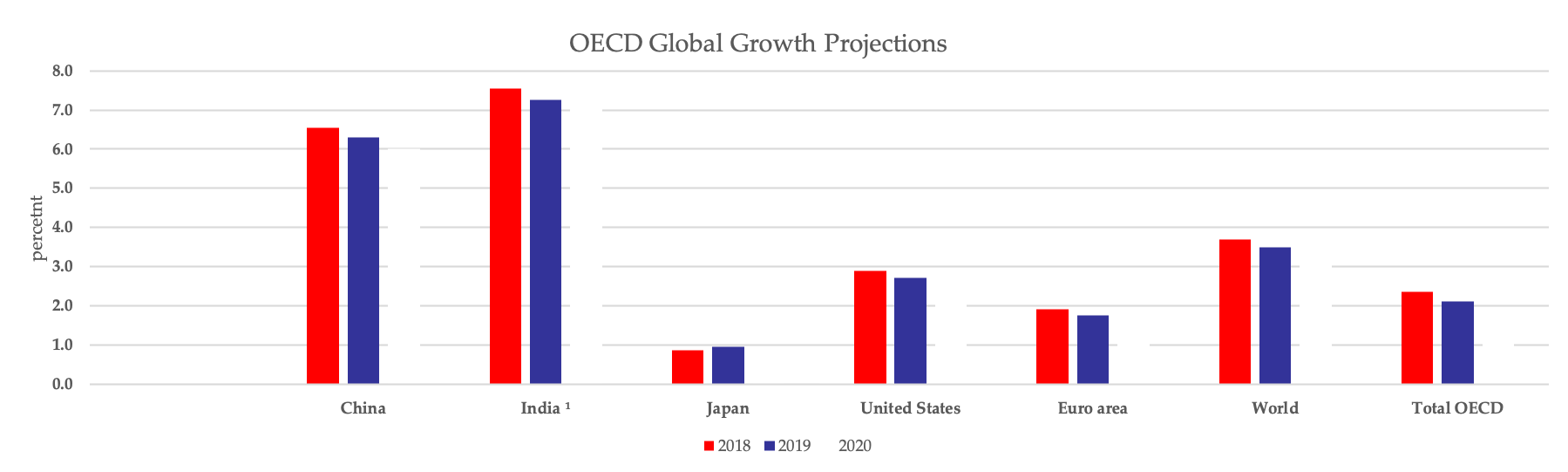

Global Economic Picture: The Organization for Economic Cooperation and Development (OECD) has presented a somewhat mixed picture in its pre-G20 economic forecast. According to the OECD, global growth remains strong, but has peaked, and is expected to slow down over the next two years. (Note that the OECD, like the IMF, rarely projects recessions, while many business economists expect a recession by 2020). Moreover, global economic prospects face escalating risks from tighter financial condition, as well as worsening trade disputes between the United States and its main trading partners. Trade and investment have slowed down, and higher U.S. interest rates and a strong dollar have accelerated capital outflows from emerging markets. Furthermore, a long period of low interest rates and sharply higher sovereign debt will constrain the margin of maneuver of governments in the event of a sharper deterioration of global economic conditions. In what follows, I will discuss some of these issues.

Trade Disputes: The growing economic and strategic rivalry between the United States and China will come in focus at the G20 meeting. The scheduled summit meeting between Presidents Trump and Xi Jinping is considered to be a last opportunity to defuse trade tensions before the United States ups the ante in the trade war and raises tariffs on Chinese goods from 10% to 25% in January. Given the hard line taken by both countries on the trade issues, an agreement is unlikely, and we could face a major escalation of Sino-American tensions in 2019. This is not good news for financial markets, which have shown a high degree of sensitivity to negative news on the global trade side. The OECD has also warned that a full-scale trade war could cut growth sharply in both countries.

Oil Markets and the Khashoggi Affair: Other key meetings at the G20 will involve the United States, Turkey and the Saudi Crown Prince, Mohammad bin Salman (aka MBS). Turkey and the U.S. intelligence agencies believe that the brutal killing of Khashoggi was most likely ordered by MBS himself. While President Trump has chosen to give MBS a pass, the issue is not going away. So far, we have seen that the Saudis have sharply increased oil production (call it the Khashoggi effect) in an apparent effort to mollify the United States. However, we are likely to see a bi-partisan effort on Capitol Hill to impose severe sanctions on Saudi Arabia, even to the point of curtailing the massive weapons contracts. Such an outcome would change the Saudi equation on oil and probably lead to cutback in Saudi oil shipments, and ultimately higher prices.

The Khashoggi affair also complicates the regional scene in the Middle East. Tensions are rising between Saudi Arabia and Turkey. Furthermore, Iran is likely to be the short-term beneficiary of the U.S.-Saudi rift both from an economic point of view (it has been allowed to proceed with limited oil sales despite U.S. sanctions) and from a strategic one (the Saudi-Israel- U.S. axis has been weakened).

The Trump Effect: Since coming to office, the Trump administration has consciously undermined key international institutions and historic alliances, replacing cooperation and consultation with confrontation, trade wars and sanctions. The most recent example was the U.S.-China war of words at the November APEC Summit. The G20 is unlikely to be immune to these trends, as the Trump administration will resist any references to free trade and international cooperation. What we are likely to see is a further isolation of the United States and a weakening of its traditional leadership on global issues.