Are We There Yet? EconVue Spotlight - June 2020

posted by Lyric Hughes Hale on June 24, 2020 - 2:22pm

Yesterday Peter Navarro declared that the US-China trade deal was dead in the water, which his boss quickly walked back on Twitter. In a world of global threats, should bilateral disputes remain our focus, or are we wasting precious time? As I wrote for the G7 Research Group:

In a world where demand will likely remain low for some time, leaders should turn their attention from mediating disputes to creating the necessary conditions for healthy trade and life itself. The focus of the G7 should be the coordination of all available resources to end the pandemic and restore public trust in the infrastructure of global commerce.

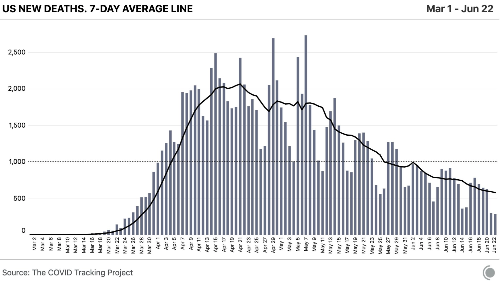

Here in Chicago, we are entering Phase 4; restaurants and stores are reopening this weekend. Despite new outbreaks, deaths from COVID-19 are in a steady decline in the US. The danger is that there will be an understandable desire to forget and go back to 'normal' without realizing that the next pandemic could be far deadlier. The sudden appearance in the US Northeast of the mosquito-borne EEE virus, which has a 40% fatality rate, could reach Chicago in a few years' time as temperatures rise.

There are signs however of lasting change in the healthcare community. On the heels of the US withdrawal of funding for the WHO there is active discussion and planning for a new global health framework not only to combat COVID, but future pandemics as well. I've referenced below a Georgetown University white paper about this new architecture. If these ideas are successful, we could see the results in about six months. An enormous amount of work by scientists and policymakers is going on now worldwide in spite of politics.

ESG investment, especially focused on a "green recovery" is also being widely discussed in this new environment. On July 8th at 4pm CDT, in advance of the ministerial-level Clean Energy Transitions Summit in Paris, EconVue will host a webinar with a specialist, David Maywald, in the field of ESG and infrastructure investment, He will be joined by some of our other EconVue colleagues with expertise in these subjects. For details and to register, please email ying@econvue.com who will send you login details.

In addition to David Maywald, we welcome Michael Kraten as a new EconVue contributor. Michael is a pioneer in the new field of behavioral accounting. He explains the concept and its importance to investors in his first article for EconVue below.

Our experts don't always agree. US employment numbers surprised on the upside last month, but Robert Shapiro felt they were misleading. Michael Lewis wrote that in fact the numbers were even better than they first appeared. You can find their comments on our virtual panel What Did the Unemployment Rate in May Tell You? Please feel free to add your comments and pose questions.

The most eye-opening, mind-changing report I heard last week was an interview on Amanpour & Co (PBS) with Raj Chetty, economics professor at Harvard and head of Opportunity Insights @OppInsights: Here is a snippet from the transcript; it is worth listening to in full:

HARI SREENIVASAN: So, the $300 billion that went through to consumers didn’t have the effect that we thought it was going to have, at least not evenly. The $500 billion that went to businesses, you’re saying, didn’t have a measurable impact on whether it actually kept more people employed or not. So, now I have got to ask the other question. This is, based on all this other information you’re looking at, what should we be doing?

Chetty's surprising answer is based on extensive data: unemployment assistance has worked to stimulate the economy far more effectively than either stimulus checks to individuals or PPP loans to companies, which he feels were ineffective. In his view, $800M was essentially wasted, and enhanced unemployment benefits should not expire next month. We are in new territory in terms of economic experimentation, and there will be plentiful data to study for years to come that could upend traditional economics.

EconVue Friends & Experts

No, the Unemployment Rate Didn’t Really Drop in May

Robert Shapiro (Also see panel above with Michael Lewis.)

Robert Shapiro argues that "Sometimes, unexpected events produce wildly inaccurate results from computer models that assume the unexpected won’t happen. Perhaps there is a glitch in the BLS unemployment model that couldn’t accommodate disruptions from the COVID black swan." We will see at at the end of this month.

Moral Mentors: Sustainability and Corporate Responsibility in the Era of Covid-19 and Black Lives Matter

Marsha Vande Berg

Well before Nike or Starbucks was even a glimmer in the eye of their founders, Howard Rothmann Bowen, a little-known economist, sat down at his desk in the 1950s in America to write why he believed companies are obliged to be responsible citizens.

USA's annual money growth exceeds 25%, the highest in its modern peacetime history

Tim Congdon

As I have pointed out above, and about which I have in fact been hinting for some weeks, the USA now has the highest annual growth rate of the quantity of money in its peacetime history. So – unlike late 2008 and early 2009 (and indeed for a few years thereafter) – I am very worried about a sequel in which annual inflation takes off into the double digits, at least in the USA. The chart above speaks for itself.

The Historical (And Yet Contemporary) Importance of Behavioral Accounting

Michael Kraten

The field of behavioral finance studies the behavior of the investment markets. Behavioral economics studies the behavior of the global economy and the numerous national, regional, and local economies. But what of the field of behavioral accounting? Why do investors need to understand the human side of balance sheets?

Big Reads: Economic Effects of COVID-19

COVID-19: A Global Pandemic Demands a Global Response

Mark Dybul Charles B. Holmes Rebecca Katz Susan C. Kim John Kraemer John T. Monahan

4/23/20 Global Health Initiative White Paper, Georgetown University (50 pages)

After withdrawal of US funding of the WTO, efforts are underway on both the executive and legislative levels to establish a new framework for global health to counter the next pandemic by year-end. A global response requires an inter-sectoral global task force with regional, national and sub-national task forces ...be created to share data, best practices, failed efforts and in real-time to track progress, identify gaps and accelerate the response.

COVID-19 in Developing Economies (free download)

Edited by Simeon Djankov and Ugo Panizza 6/22/20 CEPR Press VoxEU.org eBook. (374 pages)

Leading economists from major global institutions assess the unique impacts of the pandemic on developing & emerging markets and discuss the distinct challenges that lie ahead.

World Investment Report 2020

United Nations Conference on International Trade & Development (UNCTAD) June 2020 (242 pages)

Global FDI flows are forecast to decrease by up to 40% in 2020 from their 2019 value of $1.54 trillion. This would bring total FDI below $1 trillion for the first time since 2005. FDI is projected to decrease by a further 5-10% in 2021. A treasure trove of the latest data on trade, FDI and ESG investment, by country.

Recovery

Determination of the February 2020 Peak in US Economic Activity

National Bureau of Economic Research 6/8/2020

The recession that began in February 2020 could be the shortest in US history, after the longest expansion (128 months) since 1854.

The Unprecedented Stock Market Reaction to COVID-19

Scott R. Baker, Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, Tasaneeya Viratyosin, Becker-Friedman Institute, University of Chicago.

We have shown that the effects of COVID-19 developments and policy responses on the U.S. stock market are without historical precedent. There were more than 1100 daily stock market moves (up or down) greater than 2.5% from 1900 -2019...Not a single one of these jumps related to infectious disease outbreaks or pandemic-related developments, as they do today.

Three Reasons Stocks Are Rising

Derek Thompson 6/4/2020 The Atlantic

The COVID-19 crisis is simultaneously thrusting Americans into the pre-urban homestead economy of the 1830s, re-creating the Depression-era joblessness of the 1930s, and pulling forward the virtual economy of the 2030s.

US Unemployment Insurance Replacement Rates During the Pandemic

Peter Ganong, Pascal Noel, and Joseph Vavra 5/2020 Working Paper. Becker Friedman Institute for Economics at University of Chicago

The median replacement value of income under the CARES act: 134% with wide variation among states and income levels. Helps to explain why savings rates, retail investment, and markets are up.

The Future of Work in America is in the Office

Michael R Strain 6-20-20 Bloomberg Opinion

Don't count out commercial real estate just yet. Under “work from anywhere,” career opportunities for young people would diminish, and lifetime productivity would fall.

Covid-19 Response: Don’t Lose Sleep Over Mounting Government Debt

Paul Sheard, 6/20/20 Bloomberg Quint Opinion

The blow-out in fiscal deficits around the world triggered by the Covid-19 pandemic is leading many to ask: how are we going to pay for all of this? Aren’t we imposing a huge debt burden on the future?

"Zombie" companies may soon represent 20% of U.S. firms

Dion Rabouin 6/15/2020 Axios

The number of so-called zombie companies -whose debt service is greater than its profits-is spiking and could soon represent more than one in five U.S. firms, thanks to the coronavirus pandemic.

AEI housing market indicators, June 2020

Edward Pinto & Tobias Peter 6/3/2020 the American Enterprise Institute (AEI)

Year-to-date purchase rate lock volume is up 12% for the year. Real estate is not flagging in spite of the pandemic, supported by low interest rates.

The U.S. production of pharmaceuticals has if anything fallen since the start of the year

Brad Setser 6/16/2020 via Twitter, Council on Foreign Relations

Manufacturing and supply chains take years to shift and require significant investment, unlikely during a global recession while employers face hiring obstacles linked to the pandemic, and demand is high.

Geopolitics

‘Natural’ Disasters as Catalysts of Political Action

Mark Pelling, King’s College London and Kathleen Dill, King’s College London. 1/2006 Chatham House

ISP/NSC Briefing Paper

Anecdotal evidence suggests that the socio-political and cultural dynamics put into motion at the time of catastrophic ‘natural’ disasters create the conditions for potential political change - often at the hands of a discontented civil society. A state’s incapacity to respond adequately to a disaster can create a temporary power vacuum, and potentially a watershed moment in historical trajectories. This generates (albeit temporarily) a window of opportunity for novel socio-political action at local and national levels.

Pandemics and Pandemonium

Joel Kotkin 6/3/2020 Quillette

A thoughtful essay on the current chaos. “The inner-cities need policies that will create opportunity more than they need expressions of sympathy and solidarity from the affluent.”

How Russia Can Maintain Equilibrium in the Post-Covid Bipolar World

Dmitri Trenin 5/1/20 Carnegie Moscow Institute

To avoid becoming part of a Sino-centric power bloc and maintain international equilibrium, which is critically important to Russia’s status and self-image, Moscow must reduce its dependence on China by fostering its relations with other large economic and financial players: primarily European countries, India, and Japan.

China

South China Floods Now Affecting One-Third of Country

Ye Ruolin 6/12/20 Sixth Tone

#1 underreported story on China. Bridges & dams under threat, possibly including the Three Gorges Dam.

Covid-19 Cases in China Were Likely 37 Times Higher Than Reported in January 2020

Mouton, Christopher A., Russell Hanson, Adam R. Grissom, and John P. Godges. RAND Corporation 2020

State-Owned Enterprises in Contemporary China

Wendy Leutert, Indiana University, Hamilton Lugar School of Global and International Studies, Routledge Handbook of State-Owned Enterprises 6/2020

The governance and competitive strategies of China’s State-Owned Enterprises are no longer of interest only to China as SOE’s increase their global operations. Excellent overview.

Gender Discrimination at Work is Dragging China's Growth

Eva (Yiwen) Zhang and Tianlei Huang 6/16/20 Peterson Institute for International Economics (PIIE)

Although technically illegal, job advertisements in China still say they will not accept female applicants. The gender gap in labor force participation is widening in China while narrowing in other parts of the world, hurting China's economic growth.

FinTech

Why Bitcoin Is A Silent Protest Against Corrupt Governments Everywhere

Tatiana Koffman 6/13/2020 Forbes

Under current circumstances, I am surprised that Bitcoin hasn't done better.

PayPal, Venmo to Roll Out Crypto Buying and Selling: Sources

Ian Allison 6/22/20 Coinbase

But that might be changing soon if this report is correct.