Pulse: Monetary Policy

Are We There Yet? EconVue Spotlight - June 2020

Yesterday Peter Navarro declared that the US-China trade deal was dead in the water, which his boss quickly walked back on Twitter. In a world of global threats, should bilateral disputes remain our focus, or are we wasting precious time? As I wrote for the G7 Research Group:

The Federal Reserve Can’t Rescue the Economy from the Coronavirus

The Federal Reserve’s interest rate cut on Tuesday certainly won’t hurt the financial markets or the real economy, but as the subsequent steep drop in stock prices shows, the cut won’t help much, either. Three forces stand in the way.

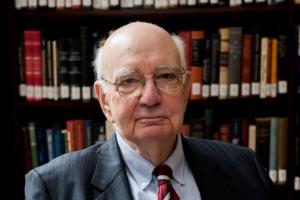

My Volcker anecdotes: The risk and reality of hubris

Of all my memories of Paul Volcker – I first met him in the early 1970s when we was UnderSecretary for Monetary Affairs at the US Treasury and I was editing The Banker – four are particularly persistent:

Volcker Offers Lessons for the Fed and Other Policymakers

The passing of legends prompts renewed consideration of their achievements and, of times, conjures not-so-favorable comparisons to their successors. Paul Volcker, who died at 92 this week, set the standard for bold monetary policy as Fed chairman from 1979 to 1987. Taking the helm amid stubbornly high and rising inflation and lackluster trend real growth, he faced the Federal Reserve’s greatest challenge since the Great Depression. Like that earlier episode, bad decisions by his predecessors had created much of the crisis.

The Economic Consequences of War - EconVue Spotlight

In 1919 John Maynard Keynes wrote the first best-seller in economics, The Economic Consequences of the Peace. The title is a bit misleading, since it is really about the cost of war. He railed against the Treaty of Versailles, correctly predicting that inequitable conditions of peace made another world war inevitable.

Currency Wars: Back to the Future

The Trump administration’s zero-sum approach to international relations is now spilling over from trade to currency wars. After spending the best part of his 2016 campaign and the first three years of his presidency railing against foreign countries taking advantage of the United States on trade, Trump and his administration have started complaining in the past few months about currency manipulation. In doing so, it is bringing us back to the 1990s, or even the 1930s.

by

by

by

by

by

by

by

by

by

by