Pulse: Growth Outlook and Business Cycle

Paradise Regained? - EconVue Spotlight

I had planned to be in Washington last week at the IMF/World Bank meetings, a chance to hear the latest policy debates and catch up with old friends. Not this spring; the meetings were entirely virtual and didn't offer much clarity beyond a dismal forecast for 2020. I have however indulged in a cornucopia of online offerings, some of which I have included below.

The Roller-Coaster Recovery

After a Devastating 20Q2 (-30% or More Drop in Real GDP), The U.S. Headed for Big Summer Gain, Late Fall Slump, and then a Sustained Post-Vaccine Expansion. Real GDP Should Finally Surpass Its 19Q4 Peak in 21Q3

Exceptionally Strong Growth of US Bank Deposits

We have another week of data on the US commercial banks’ assets and liabilities. Deposits rose by 2.6% in the week to 25th March, after a (revised) increase of 2.2% in the previous week. The increase in the fortnight to 25th March may have been the highest ever in such a short period of time. The implied annualised rate of increase was not much less than 250%.

Hale Report: Podcast Episode 7 - Interview with Michele Wucker

Today's podcast guest is a fellow Chicagoan, best-selling author Michele Wucker. Her thought-provoking book, the Gray Rhino, was published in 2016 and has been quoted by President Xi Jinping of China. Michele’s key insight is that even when we see the future charging at us, we often fail to act.

To listen to the full podcast, please click here.

The Economic Consequences of War - EconVue Spotlight

In 1919 John Maynard Keynes wrote the first best-seller in economics, The Economic Consequences of the Peace. The title is a bit misleading, since it is really about the cost of war. He railed against the Treaty of Versailles, correctly predicting that inequitable conditions of peace made another world war inevitable.

Japan Matters to America, America Matters to Japan

Written By Eleanor Shiori Hughes - November 14, 2019

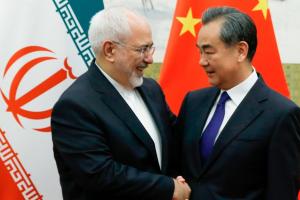

EconVue Spotlight - Iran Podcast & China's New Long March

As some of my more patient friends know, I have been toiling away at a book on Chinese monetary history during the Interwar period off and on for some years. Immersing myself in the public and private words of the historic figures of the 1930’s has perhaps sensitized me to the propensity of even well-intentioned leaders to glide into chaos. That which is unthinkable inexorably becomes inevitable.

Core PCE Inflation Lull Should Be Short-Lived

FMI’s commentary on this morning’s “shockingly low” 19Q1 core PCE deflator.

by

by

by

by

by

by