The latest from

👥 Upcoming Panel: Asia-Pacific Elections (Jul 30, 2025)

Panel Recap: The American Dream (Jul 9, 2025)

Panel Recap: The American Dream (Jul 9, 2025)

Panel Recap: The American Dream (Jul 9, 2025)

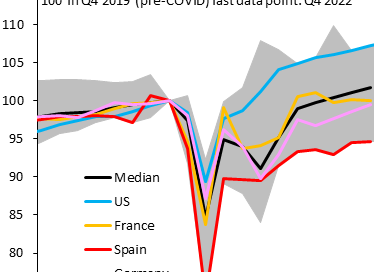

👥 After Jackson Hole Part 2 ⟲ Sep 18, 2024

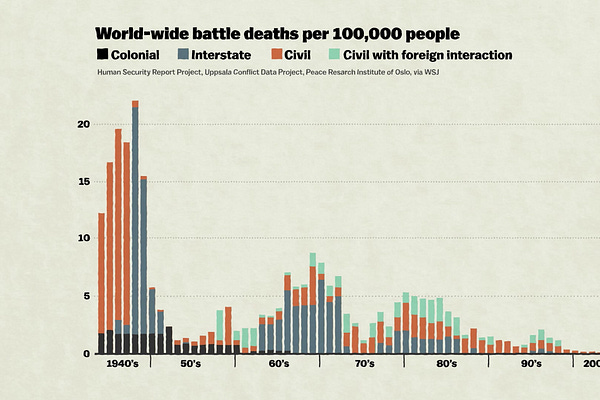

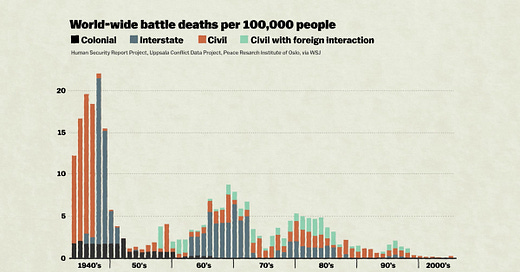

Bigger Wars on the Horizon?

👥 The Future of Money ⟲ Jul 16, 2024

👥 The Indian Election ⟲ Jun 7, 2024

🎧 The Hale Report®

🖊️ Vue⫶𝓹𝓸𝓲𝓷𝓽𝓼

econVue

Independent Voices. Expert Analysis. Unconventional Wisdom on the Future of the Global Economy:

Newsletter, The Hale Report podcast, econVue+ premium content, and off-the-record briefings since 2012.

Newsletters

↪ re:Vue

A digest of everything econVue, plus recommended reading and commentary for paid subscribers

👥 Panels

Off-the-record discussions and live events with contributors and special guests

🖊️ Vue⫶𝓹𝓸𝓲𝓷𝓽𝓼

econVue contributors share their latest thoughts on the global economy and their experiences covering it

Voices

In-depth profiles of econVue contributors and fellows