Pulse

A perspective on corporate reforms and sustainability in Japan

The evidence is still out but hopes are high that Japanese institutional investors focused on sustainability and corporate governance reforms can convince Japan Inc. to comprehensively embrace reforms designed to improve productivity and ultimately deliver higher returns. Corporate governance reforms, a cornerstone of Abenomics, started taking hold in 2014. Today, GPIF, the world’s largest pension scheme is among their most vocal champion in linking reforms to a holistic emphasis on long-term sustainable investment strategies.

Japanese Corporate Governance: A Response to Marsha Vande Berg

This is a response to Marsha's piece here.

Review of Hostile Money: Currencies in Conflict

“The purposes of money are constant, the way it operates varies hugely” says Paul Wilson at the outset – and few authors have illustrated this as interestingly as he does. Impressively erudite, he never lets his command of detail hold up the story, so that the reader is swept up in the stormy history of money’s role in some of the greatest social, political and military conflicts from ancient Rome to the cyber warfare of the 21st century.

The Power of Money: How Ideas about Money Shaped the Modern World

Forrest Capie, Professor Emeritus of Economic History, Cass Business School and author of the modern History of the Bank of England writes:

“Robert Pringle has written a book on money that is different from any other.”

He “draws on a long life in the worlds of money, banking, and central banking and on his wide-ranging interests beyond economics and the social sciences to history and the arts to reflect on the strange relationship money and society have on and to each other.”

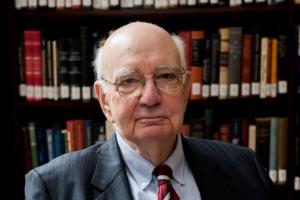

My Volcker anecdotes: The risk and reality of hubris

Of all my memories of Paul Volcker – I first met him in the early 1970s when we was UnderSecretary for Monetary Affairs at the US Treasury and I was editing The Banker – four are particularly persistent:

Hong Kong is not Crimea, thankfully

This year’s long-lasting and still on-going social turbulence in Hong Kong, a Special Administrative Region of the People's Republic of China, reminds me the Crimea crisis in 2014. There are indeed several similarities between the two events.

How Ideas about Money Shaped the Modern World: The Power of Money

Sorry to have been absent for so long. Actually I haven’t been bone idle. At least, not all the time, though I did manage to stow away on a couple of long cruises. But even then, surfing the ocean waves in my 40,000 ton dinghy, I’ve been thinking about that funny old subject – yes, my favourite, money. From a different angle – the arts and sciences, history, literature, faith and illusion. And the result is – another book! Here is the beast:

https://www.palgrave.com/us/book/9783030258931

Volcker Offers Lessons for the Fed and Other Policymakers

The passing of legends prompts renewed consideration of their achievements and, of times, conjures not-so-favorable comparisons to their successors. Paul Volcker, who died at 92 this week, set the standard for bold monetary policy as Fed chairman from 1979 to 1987. Taking the helm amid stubbornly high and rising inflation and lackluster trend real growth, he faced the Federal Reserve’s greatest challenge since the Great Depression. Like that earlier episode, bad decisions by his predecessors had created much of the crisis.

IFF Remarks on Deepening China and EU Economic and Financial Cooperation

The title of this session is leadership dialogue and the focus is “deepening China and EU economic and financial cooperation” in what this forum is calling the new global context. I’d like to use my time to look briefly at two dynamics that are affecting the evolution of this China/EU cooperation and then conclude with a comment about the importance of political leadership for quality outcomes as well as for a more peaceful world order.

Commercializing Breakthrough Drugs In a Value-Based Market

Co-authored with John Kerins, Director in Cain Brother’s Corporate M&A Advisory practice.

Key Takeaways:

by

by

by

by

by

by

by

by

by

by

by

by