RMB Redux

posted by Karim Pakravan on July 18, 2017 - 2:49pm

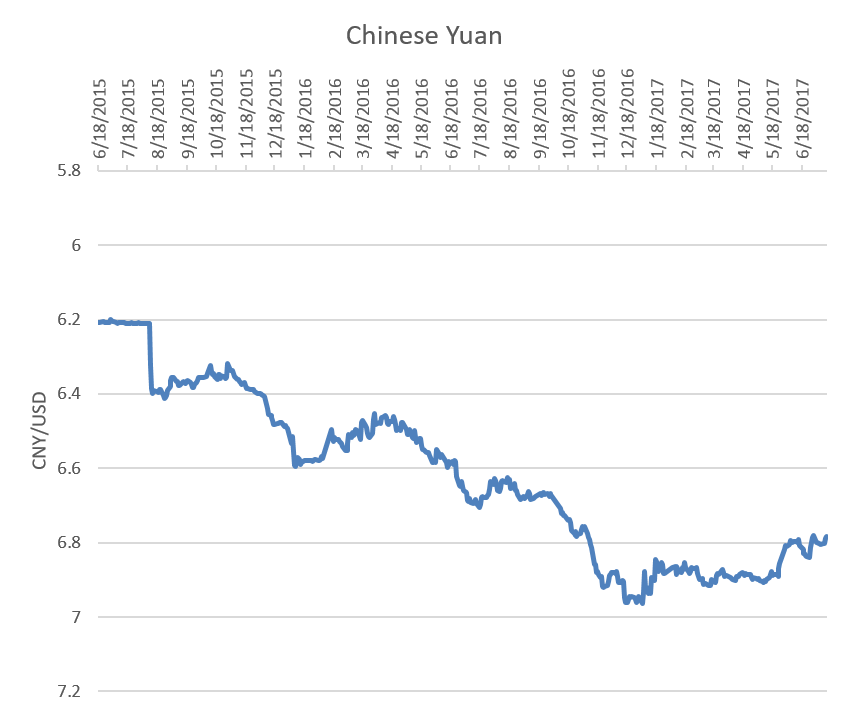

The Chinese yuan (RMB) reversed its long decline at the end of last year, gaining 3.2% against the US dollar since its low of USD:CNY6.96 reached in mid-December 2016. (However, it continued to weaken on a trade-weighted basis. At the same time, the Chinese authorities have introduced new restrictions on capital outflows, staunching the bleeding in foreign exchange reserves, and successfully halting capital outflows. Foreign exchange reserves declined by almost $1 trillion between mid-2014 and the end of the first quarter of 2017. Estimated capital outflows over this period (defined as the sum changes in foreign exchange reserves and the current account) totaled $1.7 trillion. However, foreign exchange reserves have stabilized since the end of the first quarter of 2017, actually rising by about $60 billion in the second quarter of the year.

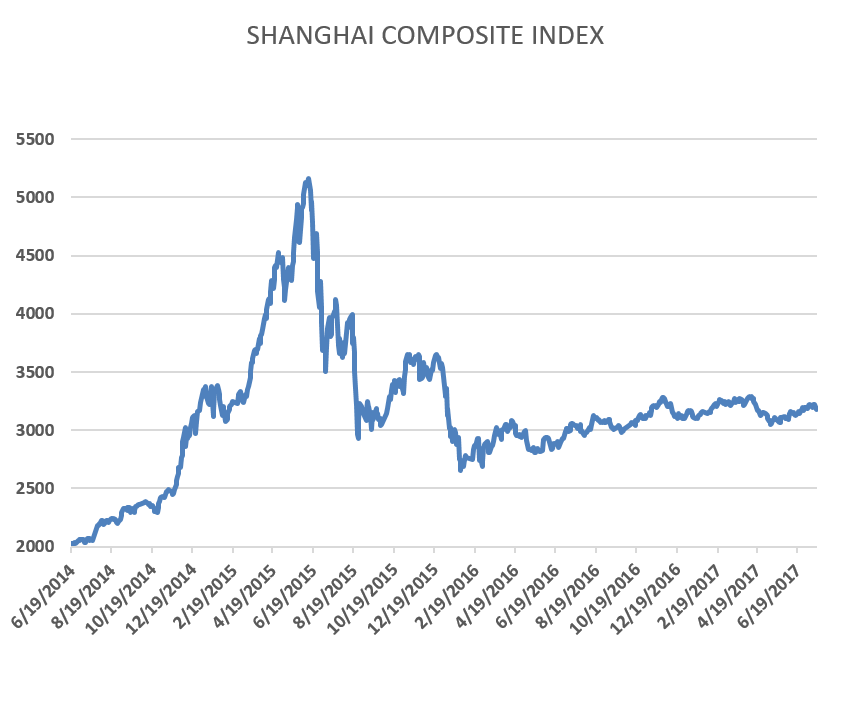

What is behind the yuan recovery? While economic growth has stabilized at a pace of about 6.8-6.9% in the past few quarters, we have not seen a major acceleration. The stock markets have recovered from their post-2015 lows, with the Shanghai composite index gaining 20% between its low point in January 2016 and the end of the year. However, it has essentially been flat in the first half of 2017. At the same time, we have seen the dollar weaken in tandem with the strengthening of the yuan. Furthermore, the Chinese central bank cracked down on capital outflows, both short term and ODI (outward direct investment).

In conclusion, while the recent data has abated concerns about the Chinese economy, the strength of the yuan is mostly a reflection of the US dollar weakness, as well as the restrictions on the capital accounts. While the central bank actions have contributed to stabilize the currency, they run in the long-term against the goal of yuan internationalization.