Mobile Payments Past and Future

posted by Collin Canright on August 31, 2017 - 9:34am

image source: Pixabay

More than 50 people showed up on a lovely late-summer Chicago evening to listen to me and two panelists from the Federal Reserve Bank of Chicago talk about “Mobile Payments: Looking Back, Looking Forward.” We were thrilled at the turnout, as was co-sponsor FinTank.

In the first of what will be an ongoing series, participants got a sense of the development of mobile payments in the United States today, including:

√ The challenges of two-sided markets or networks and the institutional and financial forces that inhibit change

√ The industry’s reliance on 40-year-old infrastructure

√ The Federal Reserve-sponsored faster-payments initiative that seeks to foster innovation

As I prepared, I looked at the last five years in mobile payments, based on my own use. The context is useful because we’re still facing the same problems today.

First, however, I confessed that I’m not a fan of mobile payments, though it wasn’t always that way. Five years ago, the Chicago Transit Authority announced a new payments system that would support near-field communications (NFC). The Google Wallet supported NFC, so I went out and got an Android phone, rather than the iPhone, which did not yet support the tap-and-pay technology.

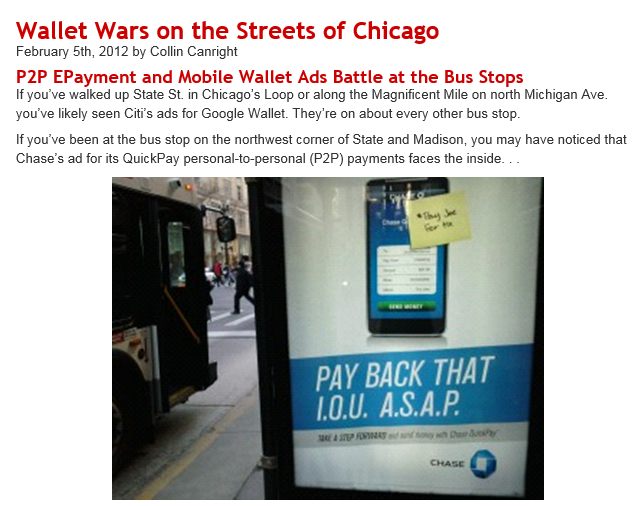

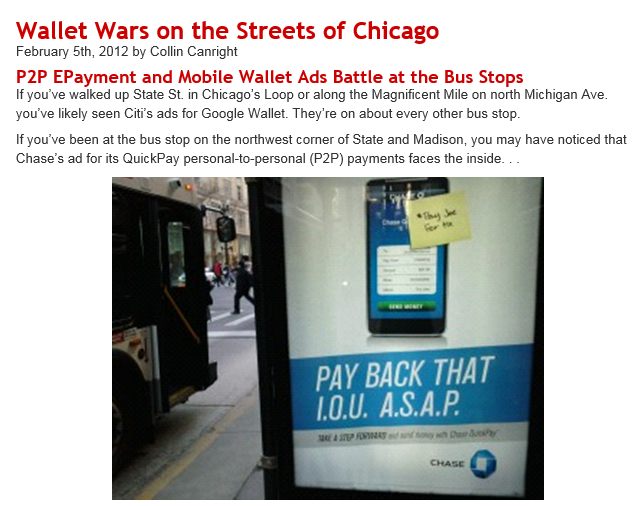

There was a lot of mobile wallet activity at the time, which I chronicled in this blog post, featuring transit ads for Chase and Citi mobile wallets.

Click the picture to read the article.

The winner? The Ventra card in my wallet, and I tap it on the bus every day, loading funds through an automated clearinghouse (ACH) transaction from my bank to the card account. This is my major mobile payment use case.

Apple Pay came next, in 2014, to much fanfare. I wrote about it for Independent Banker and followed the announcement commentary on Twitter.

I do not use Apple Pay. My bank wants me to call to complete the card set up, and though I understand the need for security and following know-your-customer laws, I didn’t want to do it. It's 2017, and bank onboarding should be automatic, but that’s another story.

Tim Cook tells us that Apple Pay is growing at a rate of 450% per year, and Fortune notes that it has a lot of international growth lately. Meanwhile, PYMNTS.com provides some other relevant mobile wallet stats.

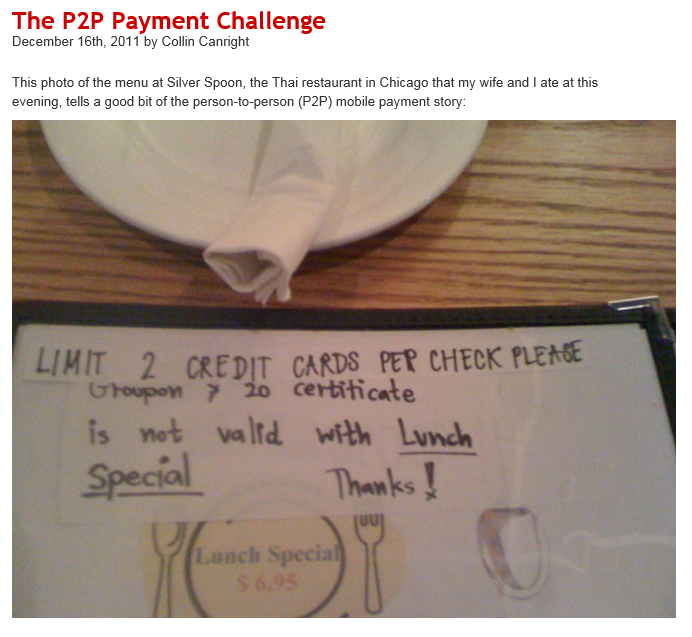

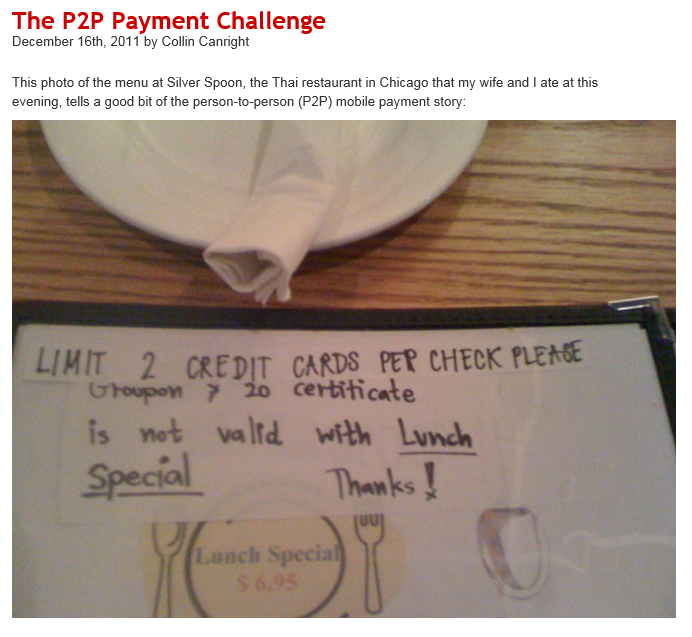

The next problem involved person-to-person payments. Whether the game is credit card roulette or wondering how many cards a server will take, this photo from 2012 is still a problem today.

Click the picture to read the article.

Venmo has the most wide-spread solution, as my summer intern impressed on me, and it’s growing nicely, as ReCode reports.

This chip, which almost two years ago brought the U.S. up to the technology that Europe may soon leave behind, is driving me to mobile payments.

It’s still a pain to know whether the terminal takes the chip or a swipe, and I feel especially out of date using the card at Starbucks, the clear leader in mobile payments in the U.S.

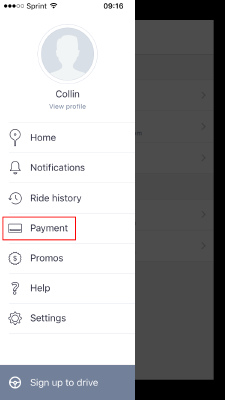

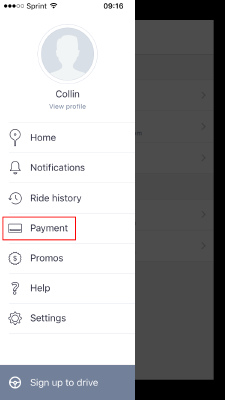

It's the ideal future when payments are just part of the background of life, as this shot of my Lyft app shows. Or just as easy as using cash, as technology in the United States in 2017 should allow.

Yet the technology is as old as this album:

When I graduated from high school listening to Talking Heads "More Songs about Buildings and Food," NACHA was able to say, "By 1978, it was possible for two financial institutions located anywhere in the U.S. to exchange ACH payments under a common set of rules and procedures."

Kandice Alter, assistant vice president, payments policy, Federal Reserve Bank, took us through the Fed’s Faster Payments final report to give us a sense of what’s to come and how the market will ultimately decide.

FinTech Rising and FinTank will be announcing future dates and topics soon. As Brian Mantel, vice president, research and market development, Federal Reserve Bank, noted in his presentation on innovation lessons, it’s the community discussions that foster innovation.

If business brings you to Chicago, be sure to stop by and participate. In the meantime, September is upon us, and Chicago is host to several major FinTech events.

In the first of what will be an ongoing series, participants got a sense of the development of mobile payments in the United States today, including:

√ The challenges of two-sided markets or networks and the institutional and financial forces that inhibit change

√ The industry’s reliance on 40-year-old infrastructure

√ The Federal Reserve-sponsored faster-payments initiative that seeks to foster innovation

As I prepared, I looked at the last five years in mobile payments, based on my own use. The context is useful because we’re still facing the same problems today.

First, however, I confessed that I’m not a fan of mobile payments, though it wasn’t always that way. Five years ago, the Chicago Transit Authority announced a new payments system that would support near-field communications (NFC). The Google Wallet supported NFC, so I went out and got an Android phone, rather than the iPhone, which did not yet support the tap-and-pay technology.

There was a lot of mobile wallet activity at the time, which I chronicled in this blog post, featuring transit ads for Chase and Citi mobile wallets.

Click the picture to read the article.

The winner? The Ventra card in my wallet, and I tap it on the bus every day, loading funds through an automated clearinghouse (ACH) transaction from my bank to the card account. This is my major mobile payment use case.

Apple Pay came next, in 2014, to much fanfare. I wrote about it for Independent Banker and followed the announcement commentary on Twitter.

I do not use Apple Pay. My bank wants me to call to complete the card set up, and though I understand the need for security and following know-your-customer laws, I didn’t want to do it. It's 2017, and bank onboarding should be automatic, but that’s another story.

Tim Cook tells us that Apple Pay is growing at a rate of 450% per year, and Fortune notes that it has a lot of international growth lately. Meanwhile, PYMNTS.com provides some other relevant mobile wallet stats.

The next problem involved person-to-person payments. Whether the game is credit card roulette or wondering how many cards a server will take, this photo from 2012 is still a problem today.

Click the picture to read the article.

Venmo has the most wide-spread solution, as my summer intern impressed on me, and it’s growing nicely, as ReCode reports.

This chip, which almost two years ago brought the U.S. up to the technology that Europe may soon leave behind, is driving me to mobile payments.

It’s still a pain to know whether the terminal takes the chip or a swipe, and I feel especially out of date using the card at Starbucks, the clear leader in mobile payments in the U.S.

It's the ideal future when payments are just part of the background of life, as this shot of my Lyft app shows. Or just as easy as using cash, as technology in the United States in 2017 should allow.

Yet the technology is as old as this album:

When I graduated from high school listening to Talking Heads "More Songs about Buildings and Food," NACHA was able to say, "By 1978, it was possible for two financial institutions located anywhere in the U.S. to exchange ACH payments under a common set of rules and procedures."

Kandice Alter, assistant vice president, payments policy, Federal Reserve Bank, took us through the Fed’s Faster Payments final report to give us a sense of what’s to come and how the market will ultimately decide.

FinTech Rising and FinTank will be announcing future dates and topics soon. As Brian Mantel, vice president, research and market development, Federal Reserve Bank, noted in his presentation on innovation lessons, it’s the community discussions that foster innovation.

If business brings you to Chicago, be sure to stop by and participate. In the meantime, September is upon us, and Chicago is host to several major FinTech events.