EconVue Weekly Spotlight July 30, 2016

posted by Lyric Hughes Hale on August 1, 2016 - 9:57am

July has seen a tsunami of news events. It is hard to take it all in, even for an economic news devotee. Overall, the key theme is slow growth. US GDP yesterday was only half what had been expected, and the Bank of Japan used just one of its three tools to stimulate its economy. The long term effects of both Turkey’s putsch and Brexit have not been fully taken on board by markets. Add to this the cloud of uncertainty over US elections, increasing violence and terrorism in Europe, sticky depressed commodity prices, a more bellicose China after the UNCLOS ruling, and a forecast for a sustained global recovery is very hard to support.

One book that has helped to clear the fog is Robert Gordon’s brilliant new work, The Rise and Fall of American Growth. Gordon, a professor at Northwestern and a long-standing member of our Chicago Financial Forum, has given a historical perspective on economic stagnation that is incredibly well researched, and incredibly well argued. His book focuses on the reasons for America’s singular productivity growth between 1920 and 1970, and then “places techno-optimism in perspective by arguing that the main benefits of digitization for productivity growth have already occurred during the temporary productivity growth revival of 1996-2004.” The italics are mine, and Gordon’s conclusion calls out “a group of headwinds—inequality, education, demography, and fiscal—that are in the process of reducing growth in median real disposable income well below the growth rate of productivity.” A sobering conclusion.

Stories in our Spotlight This Week: Bank of Japan

1. BOJ disappoints

Twitter @SoberLook 7/28/16

Smaller than expected increase in Bank of Japan purchases of ETF's. Markets and the yen are not reacting positively.

2. A Weaker Yen is Coming: Who Are the Winners and Losers?

Anthony Fensom 7/24/16 The Diplomat

3. Emperor Will Speak to the Public on Live TV in August

Japan Times 7/29/16

Most probably, Emperor Akihito's abdication speech, on August 8th. End of an era.

More Stories in our Spotlight This Week

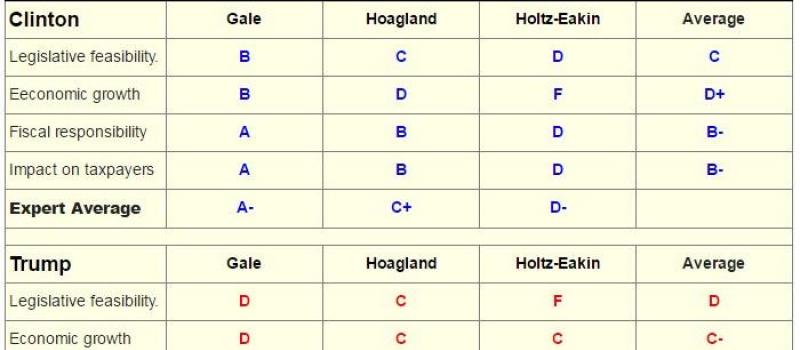

4. Grade Hillary's and Donald's Tax Plans

Brookings Econ 7/30/16

Average of expert opinions gives Clinton's tax proposals a D+ and Trump a C- in terms of impact on economic growth. For more analysis:

Full List of Hillary's Planned Tax Hikes

John Kartch, Alexander Hendrie 7/21/16 AFTR

Donald Trump Says He Had the Biggest Tax Cuts of Any 2016 Candidate

Louis Jacobson 7/21/16 Politifact

Basically, Trump would decrease taxes and increase the deficit, if the tax increase is not stimulative of the economy as a whole. Clinton would increase taxes on high income earners, and decrease the deficit. It is possible that low wage earners would lose income if business owners offset their higher taxes by decreasing wages. No perfect solution here.

5. What Will the 2016 Election Mean for Iran?

CFR 7/28/16

A key foreign policy issue for the next US President.

6. How Low Can Rates Go?

Martin Wolf 7/21/16 BBC Radio Podcast

How central banks function in a low-demand world. Wolf interviews a number of influential policymakers including Bank of Japan’s Haruhiko Kuroda.

7. Asian Defaults are Just Getting Started

Christopher Langner 7/24/16 Bloomberg

Is a wave of non-financial Asian corporate bond defaults in the offing?

8. The End of Australia's Broadband Network?

Ashley Benjamin 7/21/16 Tech Policy Institute

Australia's national broadband network has stalled, with important implications for the country's future. Australia suffered two blows to its soft power this week, the scandal over its juvenile detention units, and the withdrawal of support by the current prime minister for the past prime minister’s bid for Secretary-General of the UN.

9. These Countries Have Suffered the Biggest Fall in Wages Since the Financial Crisis

Keith Breene 7/27/16 World Economic Forum

This certainly helps to explain Brexit. Wages in the UK have fallen about 10% since 2007, the second largest dip in the EU next to Greece.

10. Brexit: London Can Safeguard Its Global City Status

Saskia Sassen 7/24/16 FT

Given London’s uncertain status following the Brexit vote, the predictions about the effect on Hong Kong’s financial market when China was about to take over sovereignty from the British in 1997 are useful. Beijing aimed to make Shanghai China’s main financial centre. The idea was that important Hong Kong markets would migrate to the mainland. That did not happen. Hong Kong is still China’s most international and strongest market. Shanghai, meanwhile, did expand as a financial centre but one geared more towards domestic investors.

11. Erdogan's Fans Ransack a Bookshop, Their Biggest Enemy.

Mahir Zeynalov 7/22/16 Twitter @MahirZeynalov

Zeynalov's Twitter thread documents the steady procession of perp walks by esteemed Turkish journalists, editors, and publishers. It illustrates just how extensive Erdogan’s crackdown is, and how long it will be before civil society is restored.

12. 'Women Should Not Laugh in Public' Says Turkey's Deputy Prime Minister in Morality Speech

Lizzie Dearden 7/29/14 Independent UK

Seriously.

EconVue Research and Insights

Data Round-Up: 16Q2 GDP Disappoints, But Inventory-Sales Mix Bodes Well Michael Lewis 07/29/16

Real growth disappointed in 16Q2. Moreover, with downward revisions in the annual benchmark, the past three quarters look pathetic, averaging +1% growth. This is bad news, but old news.

Chances for a September Rate Hike Now Higher (Far from Sure Thing) Michael Lewis 07/28/16

Today’s meeting swept away anxiety about global disruptions and reset the FOMC’s clock to April. Today’s statement was upbeat, noting that 'near-term risks to the economic outlook have diminished.'

China: Learning to do Business in Latin America R. Evan Ellis 07/29/16

EconVue contributor Evan Ellis is an expert in China’s investments in Latin America. For perspective on China in Africa, Deborah Brautigam’s blog China Africa the Real Story is without equal. Elizabeth Economy has an excellent new piece on how China’s strategy in Europe is evolving post-Brexit: China's Offensive in Europe.

Upcoming in August:

Discussion Panel: The BOJ Decision Nicholas Benes, Richard Katz, Robert Madsen, Lyric Hughes Hale August 2016

The BOJ's moderate decision on increased purchases of ETFs disappointed. We invite our experts to provide their insights on this decision. You must Login or Register to participate and post your comments on the panel.