EconVue Spotlight

posted by Lyric Hughes Hale on March 28, 2017 - 9:34am

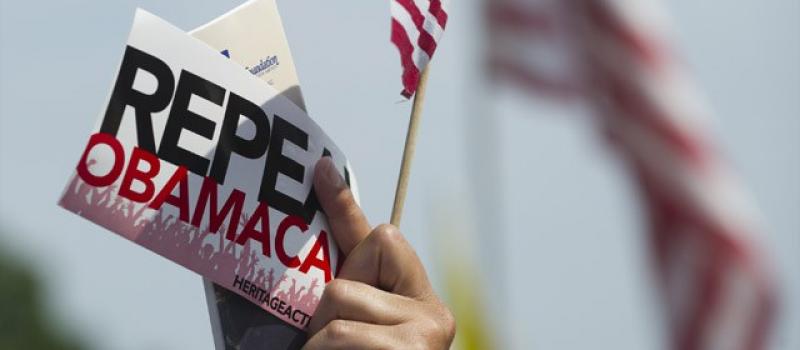

The failure of the AHCA on Friday has affected markets worldwide as they ponder the future path of other Trump policies, including tax reform and infrastructure. EconVue expert David Johnson feels that its withdrawal from legislative consideration was actually a “liberating event” and discusses the inherent contradictions of the American Health Care Act had it in fact become law. Chief among these is that it would have disadvantaged Trump supporters. To learn what Johnson thinks is coming next, please view his webcast here and contact ying@econvue.com if you’d like to receive a copy of his new report, to be published this Wednesday.

Outside Washington, global political uncertainty and economic soul-searching continue unabated. I begin my roundup of commentary with the case for a Le Pen victory, and end with an article by Carl Bildt, Problems from Hell in which he describes how things might get worse. There are positive signs however, including green shoots of entrepreneurship this spring in Japan, as described by Devin Stewart. His optimism for Japan is echoed by Richard Katz in his newest report. EconVue economist Michael Lewis sees a case for solid growth in the US, and writes that rate hikes will be offset by other factors such as a strong housing market.

Next month’s Xi-Trump summit will bring together the leaders of the world’s two largest economies for the first time. It is widely expected that the automotive industry will be a key issue, and that the US will push for market opening measures by China. Both leaders share a taste for bilateral trade agreements so this should provide an opportunity to recast the relationship. Unless a BAT or another new tariff is levied against Chinese exports, it is unlikely that the PBoC will push the value of the renminbi downward and currency concerns will not materialize. The more intractable issue is North Korea. South Korea is expected to replace its impeached president with an administration less supportive of THAAD in May, and this is what is lending an urgency to the talks. Hopefully, the Administration will be better prepared than they were with AHCA legislation which surprised Beijing this weekend. An unintended consequence of Trump’s first legislative failure is that this might weaken him in the eyes of leaders such as Xi Jinping.

STORIES IN OUR SPOTLIGHT

Yes, Marine Le Pen can win in France:Goldman Sachs strategist

Michelle Caruso-Cabrera 3/24/2017 CNBC

The Fed’s Favorite Inflation Predictors Aren’t Very Predictive

FiveThirtyEight March 3, 2017

U.S. Stores Are Too Big, Boring and Expensive

Barry Ritholtz 3/24/2017 Bloomberg

Monetary Policy in a Low Interest Rate World

Michael T. Kiley, John M. Roberts 3/23/2017 Brookings

OECD Warns of ‘Disconnect’ Between Financial Markets And Growth Outlook

Paul Hannon 3/7/2017 WSJ

A first look at Trump’s trade principles

Derek Scissors 3/1/2017 AEI

Tokyo's Ambition Generation: Entrepreneurs and Japan's New Business Culture

Devin Stewart 2/4/2016 Foreign Affairs

Is it a Risk for America that China Holds over $1 Trillion U.S. Debt?

CSIS 2017

Is It Time For China To Embrace a Property Tax?

Luodan Li 8/30/16 Chicago Policy Review

Food Security and Chinese “Comprehensive National Security”

The Jamestown Foundation March 2, 2017

Financial and Business Cycles in Brazil

Ivo Krznar, Troy Matheson 1/2017 IMF

Problems from Hell

Project Syndicate 3/24/2017

ECONVUE RESEARCH AND INSIGHTS

The State of the European Union at 60

Nikolai Tagarov

A detailed and updated analysis of the overall political and economic situation in the European Union.

US-Russia and US-China Relations in the Light of IR Theory

Nikolai Tagarov

FMI Weekly Data Preview: March 27-31

Michael Lewis

The week started on a reasonably upbeat note as the Dallas Fed’s manufacturing index held firm. The company outlook index was little changed at 18; for 17Q1, the index averaged 20, a clear improvement over the 12 average for 16Q4.( Subscriber Content)

Solid Housing/Income Fundamentals to Offset Rising Rates

Michael Lewis

Housing has been one of the clear bright spots in this lackluster expansion. Over the past four years, for example, real residential investment has grown more than +6.5% annualized compared to just +2.2% real GDP growth. Over the same period, nominal home prices have climbed nearly +30% overall, adding a significant boost to household balance sheets. Now, with the FOMC beginning to pick up the pace of tightening, it is prudent to examine how the housing sector will fare going forward. Pretty well, we believe. ( Subscriber Content)

Indian and Chinese Engagement in Latin America and the Caribbean: A Comparative Assessment

R. Evan Ellis

TOE Report March 2017

Richard Katz

Topics covered in the March 2017 issue of the Oriental Economist Report include Corporate “elephants” and start-ups - “Open Innovation”; Conditions, Not Culture - Declining US start-ups C, Behind-the-scenes maneuvers - Success at the summit; Beyond short-term summit success - An inch ahead is darkness; Economy Watch on Japan and Small Talk (Subscriber Content)

AHA! Healthcare is Both a Right and a Commodity

David W. Johnson

People deserve Appropriate, Holistic and Affordable healthcare services that are Coordinated, Accessible, Reliable and Evidenced-based. This is AHA CARE! A better debate question is whether centralized or decentralized healthcare systems can better deliver AHA CARE!

European banks soon will offer "open banking," where customers can specify who has access to their accounts for payments, under the classically Eurocratically named Second Payment Service Directive (PSD2). Last week, both the New York Times and The Economist referred to customer data as gold, and both noted that U.S. banks are not going to open up their data without a fight.

CALENDAR

Asia Financial Forum: "Fintech Revolution in Asia & US" Federal Reserve Bank of San Francisco Asia Program

Financial technology is advancing at a rapid pace that will impact the financial industry at all levels from customers to banks. Asia has proactively made remarkable progress in this area, well in advance of the U.S. Our guest speakers, as moderated by Nicholas Borst, one of our co-authors of the recent report on “Asia’s Fintech Revolution”, will continue to explore what fintech means for Asia and for the United States with our expert guest speakers at our upcoming Asia Financial Forum event, “Fintech Revolution: Lessons, Challenges, and Opportunities from Asia and the United States” on April 6 from 12 to 2pm in San Francisco.

We are also proud to be livestreaming the Asia Financial Forum event for the first time. You can access the livestream at https://twitter.com/sffed or https://www.periscope.tv/sffed