Capital-Markets FinTech

posted by Collin Canright on August 10, 2017 - 9:21am

"Until recently, FinTech was mainly focused in the payments, remittance, peer-to-peer lending and equity crowdfunding sectors. But, over the course of the last year, we have seen an increase in activity in capital markets: solutions to complex front-, middle- and backoffice problems are emerging in the form of FinTech solutions," writes Lawrence Wintermeyer CEO, Innovate Finance in an EY report, "Capital Markets: How collaboration with FinTech can transform investment banking."

Picking up on what's become a familiar theme in other sectors of FinTech, the EY authors note that collaboration, not competition, is the way forward. Startup costs are higher in the more complex systems that power capital markets than in retail banking, for instance, making collaboration more likely.

Institutional Investor’s annual Tech 40 listing provides a similar viewpoint from both incumbent and startup honorees. As in past years, a number of the winners mention blockchain in their profiles, but the quotes are more restrained this year.

In the profile for Michael Bodson, president and CEO of the Depository Trust & Clearing Corp., noted that in DTCC’s 2016 annual report Bodson “refuted ‘the overheated rhetoric that predicted our demise’ and wrote ‘now many of the key blockchain players want to engage with us on initiatives.’”

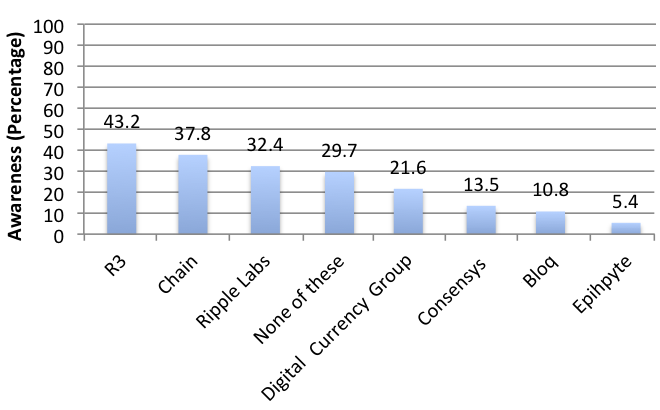

More than 59% of respondents to a FinTech Rising survey are either looking at blockchain firms for potential investments, potential partnerships, or company use. The following chart lists respondents’ awareness of specific firms.

Awareness of blockchain firms among FinTech Rising readers and webinar participants

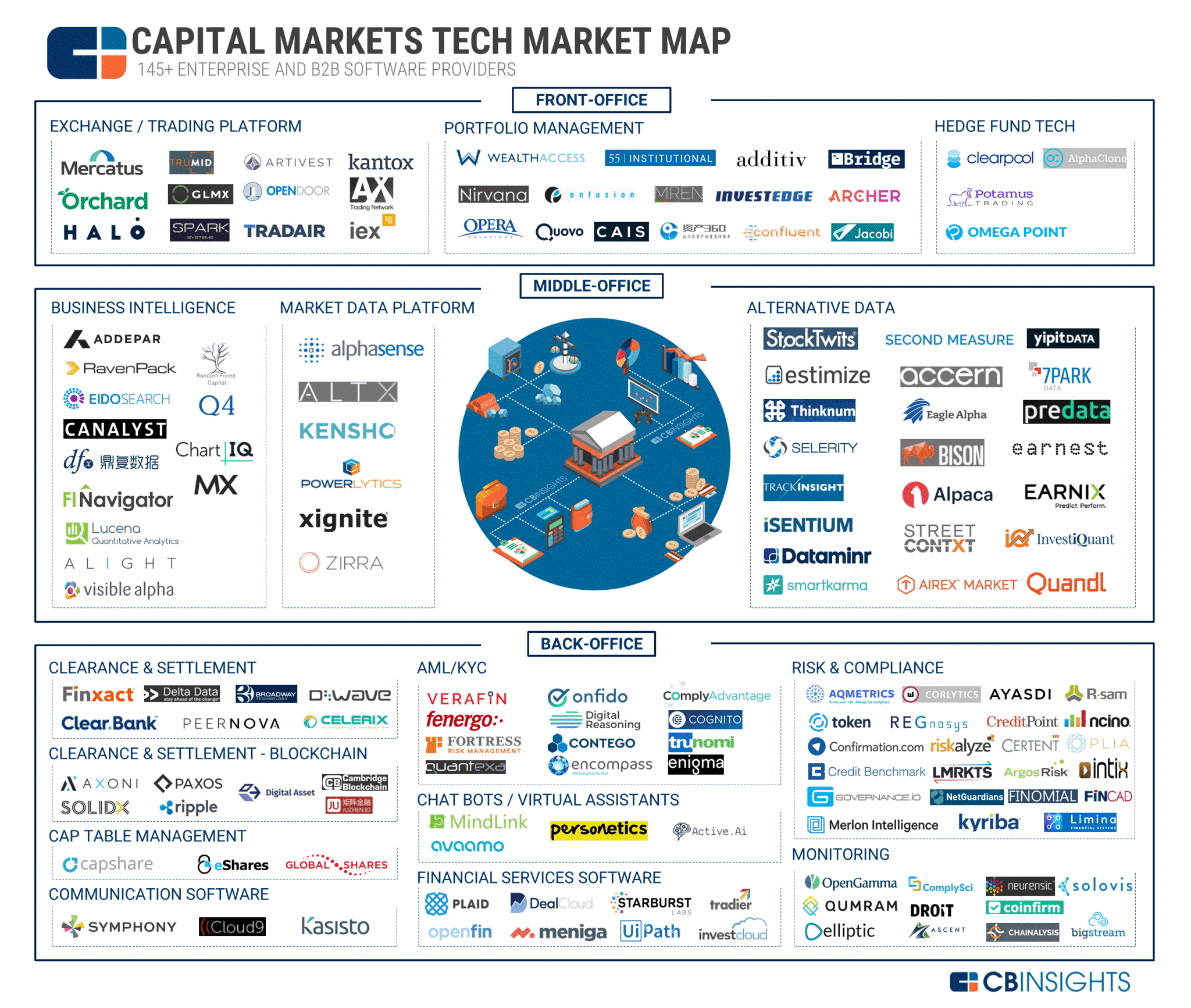

As for the remainder of the capital markets sector, banking and FinTech commentator Chris Skinner provides an overview of front-, middle-, and backoffice applications here. Click the graphic to read CBInsights's capital-market ecosystem analysis.

Yet the top of the capital-markets, investment-banking cryptofinance news belongs to the investors and warnings to the speculators:

One of the biggest exchange groups in the world has partnered with the Winklevoss twins’ bitcoin startup

The Chicago Board Options Exchange plans to partner with the virtual-currency exchange Gemini Trust, the virtual-currency exchange founded by Cameron and Tyler Winklevoss. "Under the agreement — which still has to be approved by the CFTC — CBOE would use Gemini price data on bitcoin, ethereum, and other digital assets to create new indices for traders as soon as next year," Business Insider reports.

The SEC’s ICO crackdown will help in the long-run

The Financial Revolutionist gives a measured perspective on the news that the U.S. Securities and Exchange Commission is examining the hot initial coin offering (ICO) market. “But unless your plan was to make a quick billion in ICOs in time to ring in 2018 with Sir Richard on Necker Island, the SEC news is constructive. Regardless of how valuable some tokens may become, there’s no reason that a six-month-old unproven idea deserves a $250-million valuation. Period.”

Beyond the boring blockchain bubble

Jon Evans provides a similarly pragmatic view in TechCrunch. “Speculators are piling into the cryptocurrency space in the hopes of–sometimes very literally–making money fast. . . . “But for those of us who are interested in the technology, not the money — who think that blockchains are primarily interesting because, unlike most modern technology, they decentralize power — so far this has actually been a mostly disheartening year.”

Blockchain summit examines the role of privilege in spreading a democratizing technology

As for the above mention of “Sir Richard on Necker Island,” Laura Shin of Forbes has the story of the annual event.